The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

In Q4, Hims delivered an impressive 95% year-over-year revenue increase, reaching $481 million. This strong performance capped off the 2024 fiscal year with total revenue of $1.5 billion, reflecting a remarkable 69% year-over-year growth. Free cash flow also saw a staggering 322% surge, climbing to $198 million.

Beyond its GLP-1 offering, revenue grew by 43% year-over-year in 2024, hitting $1.2 billion, underscoring the company’s robust diversification.

Overall, this marks another thrilling quarter for Hims, and I’m even more eager to analyze it through the lens of my recently launched Business Ontology Framework. If you’re unfamiliar with this approach, I encourage you to check out my original deep dive on Hims—particularly paragraph 4, where I first introduce the framework.

Here is a visual representation of the Hims & Hers Business Ontology, presented in a clear and structured format.

Next, I dedicate a paragraph to providing an update on each component of the Ontology.

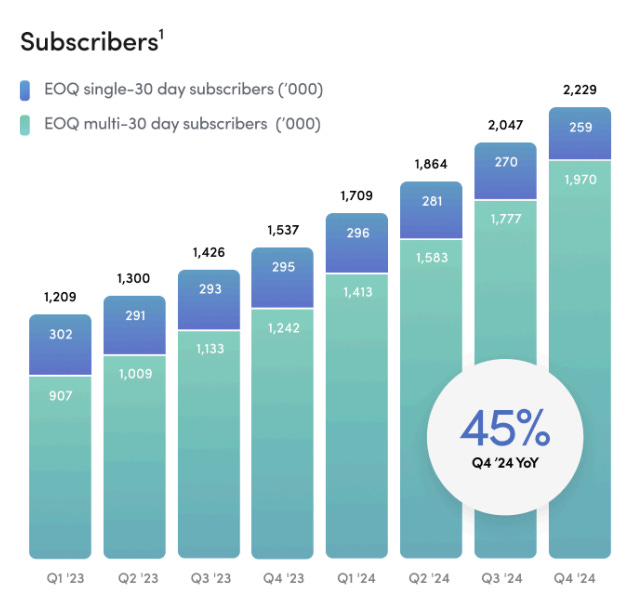

Subscribers growth

Subscriber growth remained robust in Q4, achieving a 45% year-over-year increase, up from 41%, 43%, and 44% in Q1, Q2, and Q3, respectively. This acceleration highlights the powerful momentum driving Hims & Hers, demonstrating that the marketing engine is operating at peak efficiency and successfully drawing in new users.

Marketing expenses as a percentage of revenue in the fourth quarter dropped to 46%, marking a 5-point improvement from the previous year. Monitoring the effectiveness of these expenses offers insight into whether the business’s organic growth is strengthening, further supporting my thesis that Hims & Hers thrives on an improvement flywheel.

During the earnings call, Yemi Okupe, the CFO of the company, noted,

Higher retention as a result of an increasing shift toward personalization as well as acquisition of customers organically and through lower cost channels continues to provide confidence in our ability to achieve between 1 to 3 points of leverage on our marketing spend per annum

He later emphasized,

Marketing leverage is an instrumental component of our path toward margins of at least 20% by 2030, which we believe we are on track to achieve

This reinforces the company’s strategic progress and long-term vision.

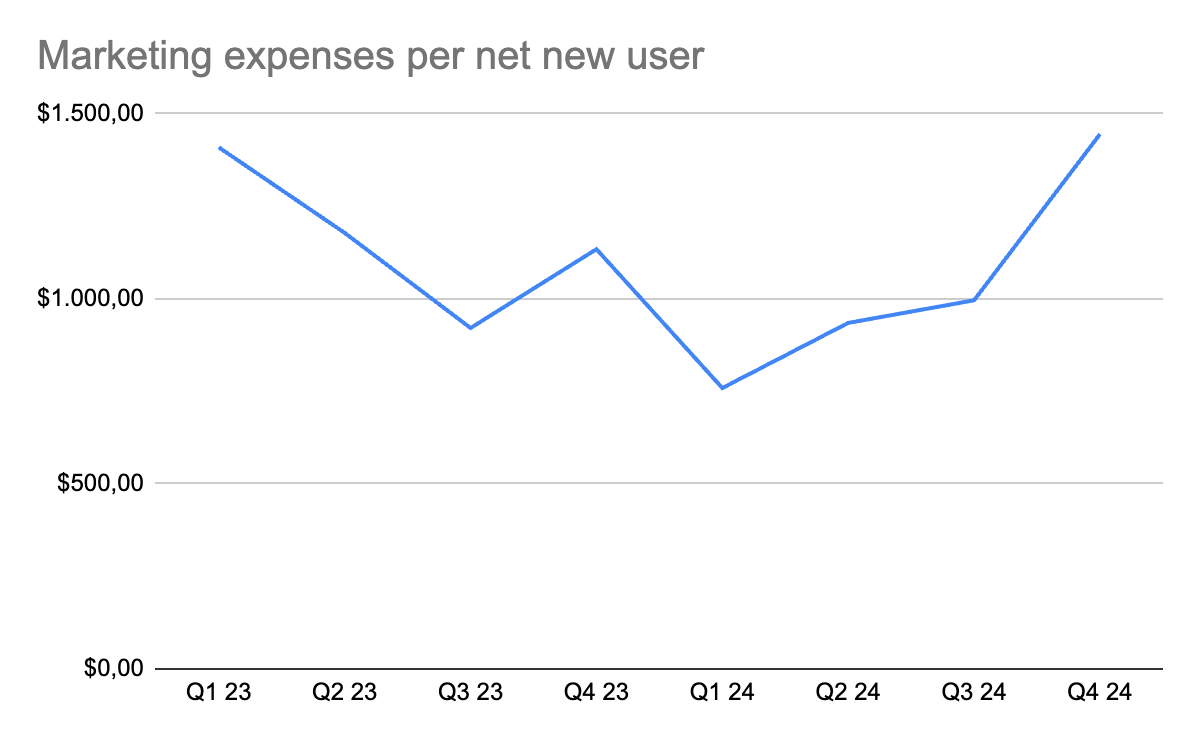

Another marketing metric I’ve developed and am monitoring is the Marketing Expenses per Net New User.

My expectation is that as Hims expands its subscriber base, the data-driven insights it gathers will enhance its offerings, making healthcare more accessible, effective, and personalized to individual needs. This, in turn, should strengthen the cycle of growth and improvement, reducing marketing costs and driving this key performance indicator lower over time. However, the current trend in the graph doesn’t yet reflect this decline, leading me to hypothesize that the timeframe we’re examining may be too brief to capture such a pattern. Regardless, it will be valuable to continue tracking this metric and observe its evolution in the future.

Another critical element influencing both customer acquisition and retention is Hims’ pricing strategy. By sharing efficiency gains—achieved through scale and vertical integration—with its users, Hims attracts new customers, fosters loyalty among existing ones, and strengthens its competitive moat. Management’s commitment to this approach was evident in statements made during the earnings call.

Yemi Okupe explained,

Line of sight to future operational efficiencies gave us comfort to make our injectable offering even more affordable. We reduced the price for our 12-month SKU from $199 a month to $165 per month in December. The majority of weight loss subscribers are now opting for treatment plans of 6 months or more, which we believe will translate into strong retention and improved adherence for our weight loss subscribers. Similar to previous strategic pricing actions, we are confident that these changes will be long-term accretive to the platform and provide a path to unlock economies of scale in the future.

He also added,

We expect to integrate lab diagnostic capabilities into our platform in a way that allows us to offer it to subscribers at a low cost or, in some instances, for free. We believe lab diagnostics can be an additional value-add service for subscribers that serve as a foundation for more personalized treatments as well as enable expansion into other specialties in the future.

These remarks underscore Hims’ focus on delivering value while paving the way for sustained growth.

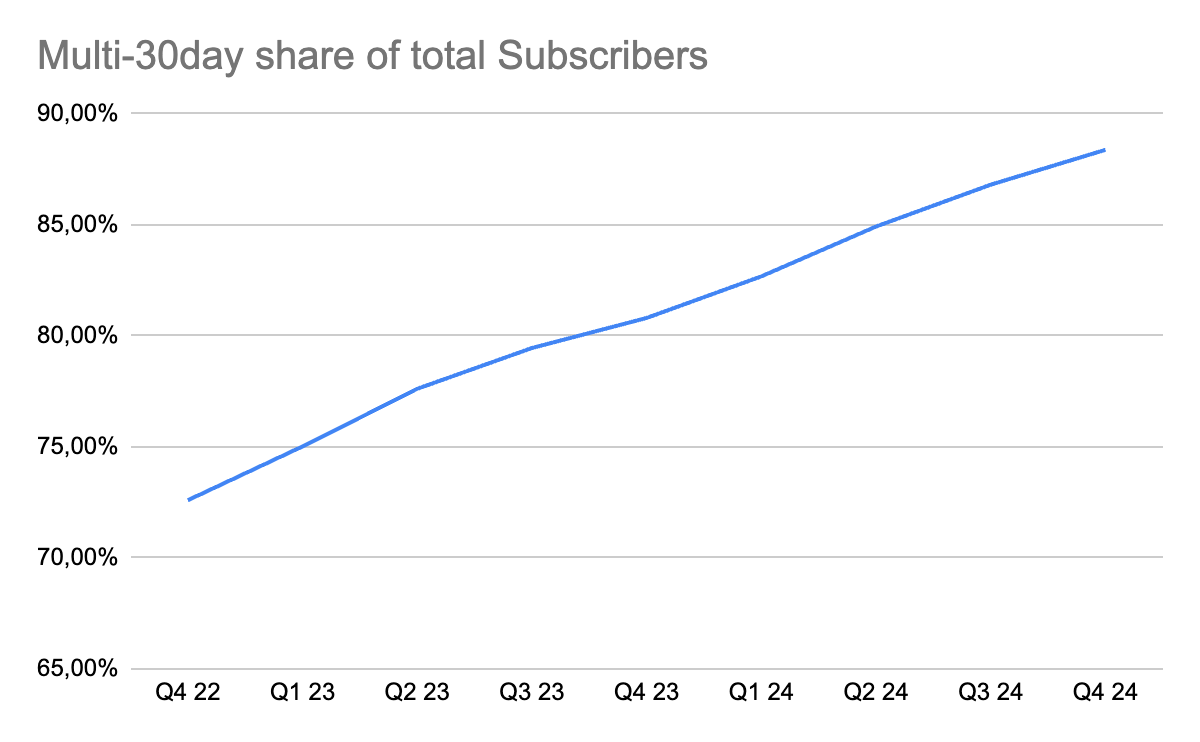

Multi-30 days share of total subscribers

The proportion of multi-30-day subscribers within the total subscriber base continues to rise at a steady pace, almost defying logic—as if the figure could somehow exceed 100%!

The personalization of treatments stands out as a cornerstone of Hims’ competitive moat, fostering customer loyalty and creating high switching costs that deter users from seeking alternative providers. The effectiveness of management’s strategy is once again borne out by the data: over 55% of customers now subscribe to at least one personalized solution, up from approximately 50% in Q3.

At the heart of this successful personalization—and the resulting customer stickiness—lies the vertically integrated platform that Hims’ leadership continues to refine and enhance each quarter through targeted investments. This is precisely why I’d like to see the majority of the company’s cash reinvested into further improving Hims’ ability to deliver reliable, cost-effective, and tailored solutions. Fortunately, management provided ample evidence during the latest earnings release that this is indeed their focus.

For instance, the acquisition of a provider of at-home whole-body lab testing was highlighted by Andrew Dudum, the CEO of the company:

With this additional capability, we will be able to test for a wide range of critical biomarkers across heart, hormone, liver, thyroid and prostate, helping to proactively identify individual risks for disease. We believe this type of comprehensive health testing should be available to everyone given the possible life-altering learnings. Given this, we look forward to expanding the value each Hims & Hers subscriber receives this year with comprehensive testing at extraordinarily affordable cost to our customers. Whole body testing gives providers even more insights into their patient's health, enabling a more holistic individualized treatment plan inclusive of personalized medications, supplements, workout routines and nutrition. Whole body lab testing will also enable us to expand into specialties such as menopausal support, low testosterone and more. With this acquisition, we are elevating the personalization of care individuals will be able to access on our platform. Expanding data sets enable us to identify elements of a member's health such as vitamin deficiencies and unoptimized health indicators, leading to better personalization of treatment through expanded offerings that take these diagnostic components into account. As we deepen personalized care, we can offer investments across our nearly 0.5 million square foot footprint across Ohio, Arizona and California. We'll set the foundation to potentially move from offering hundreds of personalized treatment variations to eventually offering thousands of treatments over the coming years.

Additionally, about the other recent acquisition of a California peptide facility was noted by Dudum:

As we work to address chronic conditions and areas of need among Americans, this facility will provide the ability to explore innovative advances in preventative health, metabolic optimization, cognitive performance, recovery science and biological resistances. I'm thrilled with the potential range of treatments in peptide science, and we are committed to being at the forefront. We believe that this acquisition will provide us with opportunities to more closely participate in this innovation and also bolster our domestic supply chain for treatments that could be critical to America's future.

Looking ahead to 2025 investments, Yemi Okupe elaborated:

We are investing to expand capacity for a greater breadth of personalized offerings through investment in equipment with increased automation capabilities as well as the launch of a larger facility in Arizona later this year. Our ambition is to have the capacity to leverage additional de-identified data points from interactions on our platform and lab diagnostics to increase the depth of personalized treatments available to subscribers whether that be through additional form factors or multi-condition treatments.

These efforts signal a clear commitment to scaling personalization and solidifying Hims’ leadership in the space.

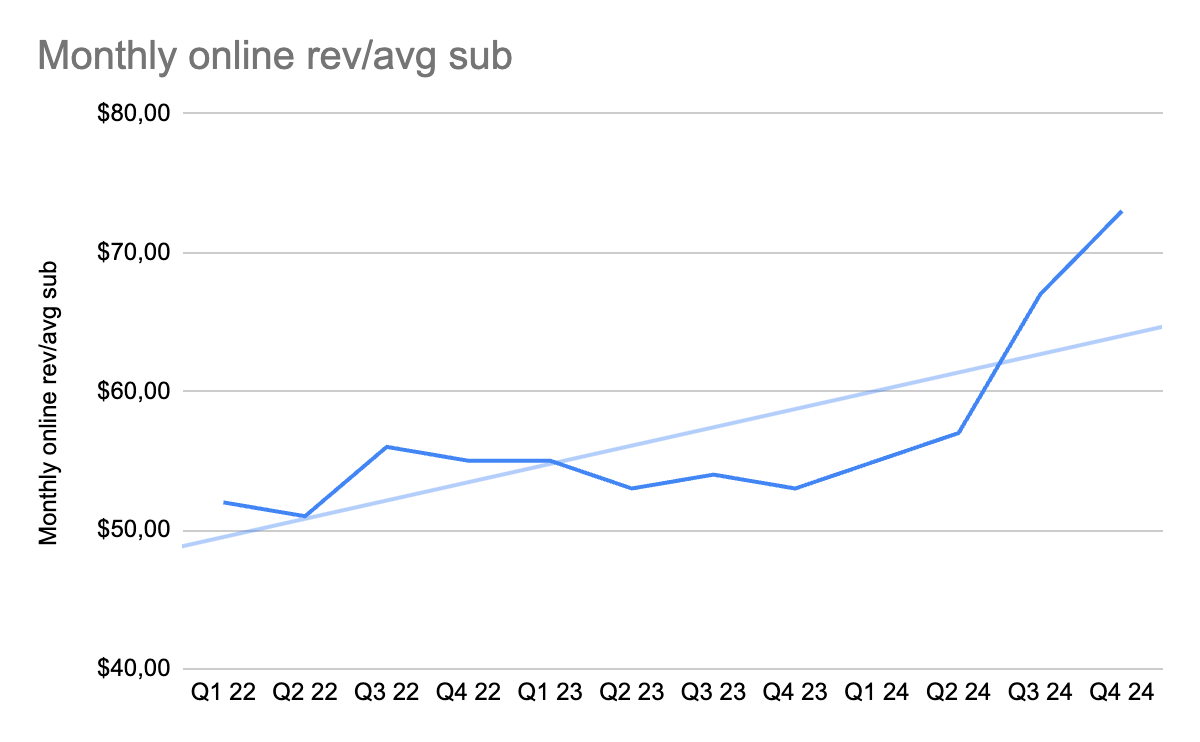

Monthly online revenue/average subscriber

Monthly online average revenue per subscriber rose 38% year-over-year to $73 in the fourth quarter, accelerating at an even steeper pace. This trend further demonstrates that customers are pleased with the services they receive, as evidenced by their growing willingness to invest more in the platform through additional treatments. Yemi Okupe highlighted the scaling of GLP-1 offerings and subscribers’ shift toward premium personalized solutions as the key drivers behind this growth.

To ensure this metric continues trending positively, I’d like to see Hims maintain its focus on expanding the range of treatments it offers while outlining a long-term roadmap to introduce additional services. Once again, management has exceeded my expectations in this regard.

Yemi Okupe stated,

We expect more capital investments across a few key areas in 2025 to continue building toward our long-term vision for the company. These areas include: first, an investment in expansion of sterile capabilities and capacity within our 503(a) and 503(b) facilities. These investments will ultimately enable us to more economically provide offerings such as liraglutide on our platform, which we believe will further enhance the durability of our weight loss offering. Additionally, sterile capabilities provide a critical component necessary to expand into other areas such as menopausal support and low testosterone in the future.

He added,

We expect to integrate lab diagnostic capabilities into our platform in a way that allows us to offer it to subscribers at a low cost or, in some instances, for free. We believe lab diagnostics can be an additional value-add service for subscribers that serve as a foundation for more personalized treatments as well as enable expansion into other specialties in the future.

Okupe further noted,

We will continue our focus on strengthening the long-term durability of our domestic supply chain through investment in our recently acquired peptide facility. We view this facility and peptide capabilities as providing an additional long-term anchor for a focus on U.S.-based operations as well as an opportunity to explore innovations in medicine made possible through peptide development in the coming years.

Andrew Dudum chimed in,

You’ll obviously see lab work be built into MedMatch in a way that expands the range of diagnostic capabilities and treatment capabilities.

He also shared a visionary perspective:

One of the things that I think about a lot as an entrepreneur is what are things that the ultra-rich have access to and then how can we broaden that and give that to everybody. So things that people have are on-demand therapists, right? They’ve got nutritionists. They have fitness coaches. They have meditation coaches. These are people that are in your life, helping you to live a healthier lifestyle. I think we are capable of building incredible AI versions of all of those coaches, which really change the paradigm for how easy it is to change the lifestyle dynamics in your house and ultimately expand that to tens of millions of more people down the line.

Management continues to impress, delivering not just strong results but also a compelling vision for Hims’ next big leap, adding significant upside to my thesis. Dudum elaborated,

As our verticalized capabilities and platform get stronger, we see a path to export our capabilities beyond the walls of Hims & Hers, helping legacy health care enterprises transform to be capable of delivering the same quality, efficiency and personalization for their patients.

On the topic of AI coaches, he continued,

Now at the end of all of this, I think what is maybe even the most exciting from an AI standpoint is as we build these fairly proprietary models internally and validate them internally across our data set, I think there’s one day the opportunity to open this up and in partnership actually help power the existing legacy health care systems and help transform those legacy health care systems to actually be able to deliver the Hims & Hers quality and experience and personalization at scale.

This bold ambition reinforces Hims’ potential to reshape the broader healthcare landscape.

Conclusion

In conclusion, all the key metrics I’ve tracked continue to perform strongly, reinforcing my investment thesis for Hims & Hers. Among my portfolio holdings, HIMS 0.00%↑ stands out as the stock I’m most confident in at this moment, underpinned by its consistent execution and forward-looking strategy.

This confidence is further strengthened by the resolution of the GLP-1 shortage that once clouded its prospects. Notably, management’s guidance for the 2025 full year—excluding any contribution from commercially available semaglutide dosages—projects revenue between $2.3 billion and $2.4 billion, reflecting an impressive year-over-year growth of 56% to 63%.

With this supply challenge now behind us, the bearish arguments linked to it are losing ground, enabling investors to redirect their focus to the robust fundamentals driving Hims’ momentum. As these distractions fade, the company’s compelling business model and ambitious long-term vision are poised to take center stage, paving the way for its stock price to track the upward surge of free cash flow per share, eventually, which is set to skyrocket.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the February 8th 2025.

+6% DDTDSee you in the next update!

Excellent work, Lorenzo! Keep it up.