Hims and Hers’ Business Ontology

A critical factor in leveraging the quantum leap in AI technology

The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

While studying this company, I noticed a crucial element that—without intentionally searching for it—consistently appears across all my picks. Tesla, Rocket Lab, Oddity, Meta, Duolingo, Lemonade, and now hims, all clearly demonstrate a competitive advantage built on the same strategy.

So, what do these companies have in common?

It all comes down to a critical factor in leveraging the quantum leap in AI technology that we’re currently experiencing.

And that factor is… drum roll... the good old vertical integration.

These companies were founded with the intent and structure to control several aspects of their supply chain and especially have direct access to the final customer, often with direct to consumer models. This level of control allows them to build and operate an effective digital twin, giving them access to the entire stack of data. As a result, they can train their AI models with comprehensive data, continuously optimize processes across the supply chain, and pass efficiency and quality improvements directly to their customers. And they can repeat this cycle over and over, reshaping their supply chains to be as efficient as possible.

In contrast, most incumbents and traditional players were built on the opposite approach—maximizing horizontal integration. By focusing on a specific layer of the supply chain—the most profitable one for large corporations—they achieved efficiency and flexibility. However, because they only capture a fraction of the total value generated across the supply chain, they lack the incentive to optimize it as well as the ability to maximize the value delivered to the end-customers. The risk of value shifting to another part of the chain keeps them in check, a classic case of the innovator's dilemma.

I have a strong feeling that many of these horizontally structured companies will be disrupted, one by one, and ultimately replaced by AI-powered startups designed with vertical integration at their core.

Index

Hims does it differently

The platform effect

How personalization increases Switching Costs

Hims Business Ontology

Conclusion

1. Hims does it differently

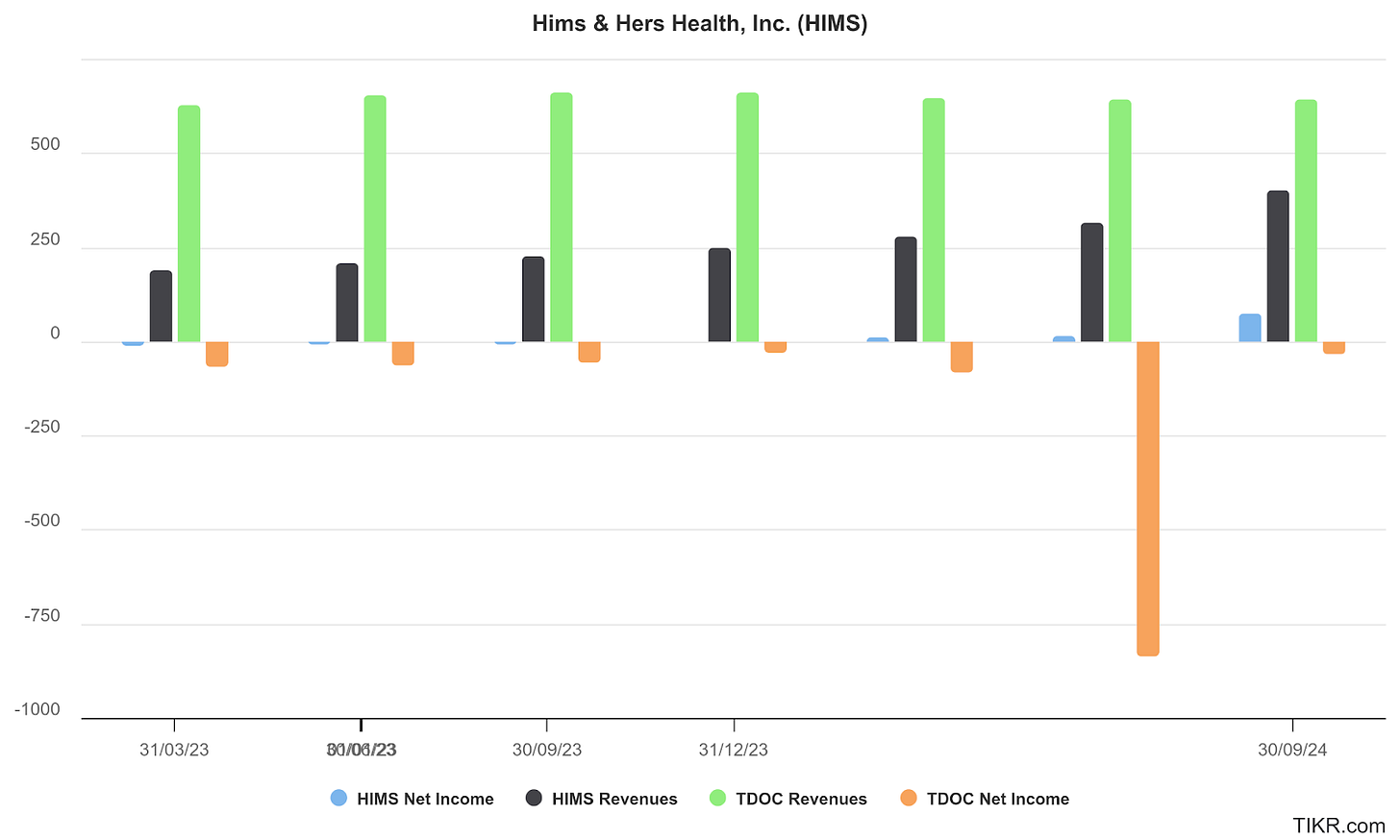

In recent years, we've seen a bunch of telehealth companies aiming to capitalize on new opportunities. However, many, including Teladoc Health, one of the most recognized names on Wall Street, face challenges in achieving consistent success and profitability.

Now, let's consider Hims and how they're innovating to disrupt the industry.

Hims has been redefining healthcare accessibility with a focus on men's and women's wellness, mental health, sexual health, hair loss, dermatology and weight loss. Through a direct-to-consumer model, Hims has carved out a niche in the healthcare industry by emphasizing convenience, affordability, and personalization.

Their platform connects subscribers with a network of affiliated doctors to provide personalized treatments—tailored based on the personal data patients provide, which Hims uses with consent to enhance treatment effectiveness and minimize side effects.

This strategy is designed to maximize value for customers by offering personalized service at an affordable price, leveraging economies of scale to achieve efficiency gains that are passed directly to consumers.

Their latest strategic initiatives, as outlined in the Q3 2024 shareholder letter, underscore a significant commitment to counter-positioning through vertical integration. Specifically, they state:

Accessible pricing through verticalization: Verticalization of areas of our operation within the Weight Loss specialty will enable us to drive increased efficiency, as well as an ability to deliver a more customized experience to our users.

This approach goes beyond mere cost control—it's about fundamentally reimagining how healthcare can be delivered.

A pivotal step in this direction has been the recent acquisition of Medisource, which they describe as:

Our first 503B compounding outsourcing facility represents a step in this direction. Moving into 2025, we expect increased volume at this facility, along with additional investments in our 503A infrastructure to unlock a broader set of personalized capabilities.

This acquisition is part of a broader strategy to gain greater control over the supply chain, reducing costs and enhancing service personalization. The shareholder letter further emphasizes this impact:

Over the past year, we have demonstrated that providing solutions at more accessible price points can strengthen relationships with existing customers and attract new individuals to the platform.

By doing so, Hims is increasing competitive pressure on traditional pharmacies and segments of the healthcare delivery system, offering an alternative to conventional drug distribution and prescription models.

In the Q3 earnings call, discussions around pricing and efficiency further reinforced this strategy. When asked about their pricing approach, CFO Oluyemi Okupe explained:

I think what we constantly do as we unlock efficiency gains, as we look for the best vehicles to pass that through to consumers, some of this you're seeing in the rollout of some of the newer products like the multi-condition treatments in sex and hair. We were able to roll that out for as low as $49 per month for both conditions.

This statement highlights their commitment to leveraging technology and operational efficiencies for consumer benefit while experimenting with pricing models to maximize value delivery.

The Q2 shareholder letter adds further context regarding the acquisition of Medisource, stating:

We anticipate this will significantly expand the level of customization and breadth of offerings we can provide our customers, while also positioning us to recognize meaningful efficiencies over time

Vertical integration is viewed as a core competency that enables Hims to "drive further accessibility for a broadening selection of solutions and to continue to pass value back to customers."

To support this vision, they are investing in technologies such as robotics and specialized software, aiming to create an innovative platform that evolves over the next three years. This positions Hims as a leader in both efficiency and customer experience (CSAT) in the telehealth sector.

Ultimately, verticalization plays a crucial role in personalizing the service, which is essential for fully onboarding patients and driving deeper engagement. As patients become more involved, they actively contribute data to the Hims’ Electronic Medical Record (EMR) system, strengthening its AI engine.

MedMatch by Hims & Hers uses AI and big data from its user base to provide personalized healthcare recommendations. It analyzes anonymized patient data and historical treatment outcomes to suggest (to Hims's providers) the most effective treatments for conditions like anxiety and depression, aiming to improve patient outcomes and satisfaction.

This, in turn, enhances the personalized experience for each patient, creating a continuous, self-reinforcing loop of improvement.

Through these strategic moves, Hims is not just competing in the telehealth space—they are actively redefining it. They are setting a new benchmark for how healthcare services can be both personalized and accessible, challenging traditional healthcare models with a fresh, technology-driven approach.

While competitors such as Teladoc, Ro, and Amazon are also pursuing vertical and horizontal integration, along with personalization, Hims’ advantage lies in its customer-centric approach. Rather than targeting the broader market, the company focuses on a select set of conditions, allowing it to gain deeper insights into specific patient cohorts, iterate more rapidly on the patient experience, and drive higher customer satisfaction. Every service and investment is designed to maximize patient value, fueling exceptional organic growth and further strengthening its competitive moat.

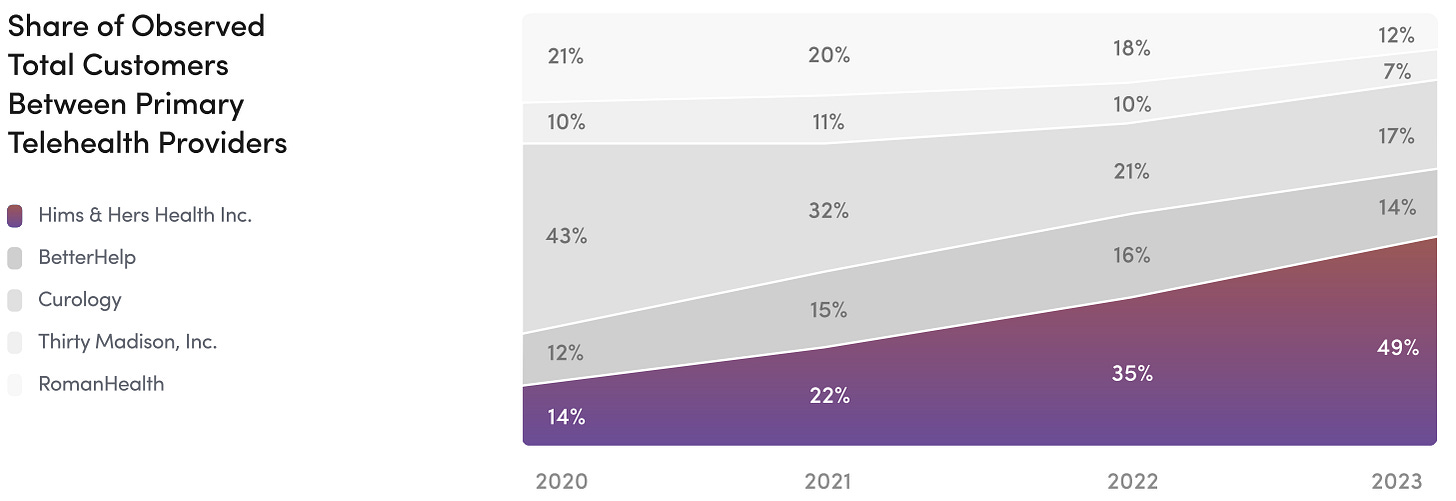

Financial results support this thesis, as Hims is rapidly gaining market share at the expense of its main telehealth competitors.

Hims is also narrowing the revenue gap with Teladoc and has already surpassed it in net profit, achieving consistent profitability quarter after quarter—despite being in the market for far less time than Teladoc (2017 vs. 2002)

Moreover, Hims' strategy presents a significant challenge to established healthcare players, many of which struggle to adapt to new business models and technologies that don't align with their current market demands. By focusing on consumer-centric healthcare delivery, Hims disrupts the status quo with convenience and personalization—areas where traditional healthcare providers are often slower to innovate due to entrenched practices and regulatory constraints.

Here is how Hims’ counter positioning is challenging the incumbents:

Pharmacies: Traditional brick-and-mortar and even some online pharmacies might see a reduction in profits as Hims offers medications directly to consumers at lower prices and with better effectiveness and lower side-effects, bypassing traditional retail pharmacy models.

Distributors/Wholesalers: Hims, by compounding its own medications or sourcing them directly, can reduce the dependency on pharmaceutical distributors or wholesalers, thereby cutting into their profits since they are typically in the middle of the supply chain, adding markups at each step.

Insurance Companies: While not directly stealing profits, Hims' model can influence insurance companies by offering an alternative where patients might prefer to pay out-of-pocket for Hims' services, especially if those services are cheaper or more convenient than going through insurance-covered channels. This could lead to a decrease in premiums collected or a shift in how insurance companies must negotiate with pharmacies or manufacturers for better rates.

Pharmaceutical Companies: To a lesser extent, because Hims primarily deals in generic or compounded medications rather than innovator drugs, but by focusing on generics and offering them at lower prices, Hims might pressure pharmaceutical companies to reconsider pricing strategies for their generic lines to stay competitive. Moreover, if Hims expands into more areas of drug production or distribution, this pressure could increase.

Healthcare Providers (Doctors, Clinics): By offering a direct-to-consumer model with its own network of doctors, Hims might reduce the number of traditional office visits or consultations, thereby impacting the revenue of healthcare providers who rely on these visits.

Despite Hims' primary impact being in telehealth and direct-to-consumer health services rather than the broader pharmaceutical manufacturing sector, the company's strong strategic direction and adept industry navigation suggest that its potential to disrupt other tiers of the healthcare supply chain in the near future should not be underestimated.

2. The platform effect

Hims is a telehealth platform connecting patients with healthcare providers (doctors) for virtual consultations, prescriptions, and wellness products. Patients benefit from convenient, affordable and personalized care, while providers gain access to a broad patient base, streamlined workflows, AI powered insight and support in delivering personalized treatment.

In its Q3 shareholder letter, Hims reported that the platform surpassed 2 million subscribers, growing 44% YoY, with newer specialties like Weight Loss driving significant growth in patient-provider interactions, further increasing the value of its underlying technology.

On the other side of the network, high-quality providers are also growing: “provider satisfaction on the platform is strong, evidenced by monthly retention rates which consistently fall above 95%”. Hims believes this is largely a result of high safety standards of their platform, as well as the set of compelling tools that they offer on the platform.

Andrew Dudum explain in the Q3 earnings call:

Technology on our platform removes administrative overhead on providers and equips them with products and tools to better address individual patient needs. Providers on the Hims & Hers platform have access to tools with a proprietary EMR that automate notes on patients, programmatically flag certain risk and leverage structured data to help them highlight important concerns and dynamics for providers. Additionally, capabilities such as MedMatch by Hims & Hers, our proprietary AI technology, support providers in identifying ways to balance weight loss results with a side effect management, including medication and titration schedule adjustments. Third, a wide breadth of personalized doses options means that providers on our platform can serve a broader set of patients

This has allowed them to expand their network to over 1,000 providers by the end of the third quarter, representing approximately 65% year-over-year growth from the 600+ providers in Q3 2023.

The company's attitude to network effects is evident in how it employs this data. Each new subscriber contributes to the vast pool of health-related data, which Hims & Hers uses to refine and personalize its offerings. Tools like MedMatch by Hims & Hers and clever routing are becoming increasingly sophisticated, as noted in the shareholder letter,

By synthesizing the feedback and insights from each new cohort, we expect tools like MedMatch by Hims & Hers and clever routing will continue to become smarter and more efficient, powering a Hims & Hers experience that can drive customer satisfaction and loyalty for decades

This is a classic example of positive feedback loops where more subscribers lead to better data, which leads to better service, which in turn attracts more subscribers.

This feedback loop indicates that Hims is fostering a virtuous cycle in which its growing user base drives service improvements, further attracting new users through word of mouth.

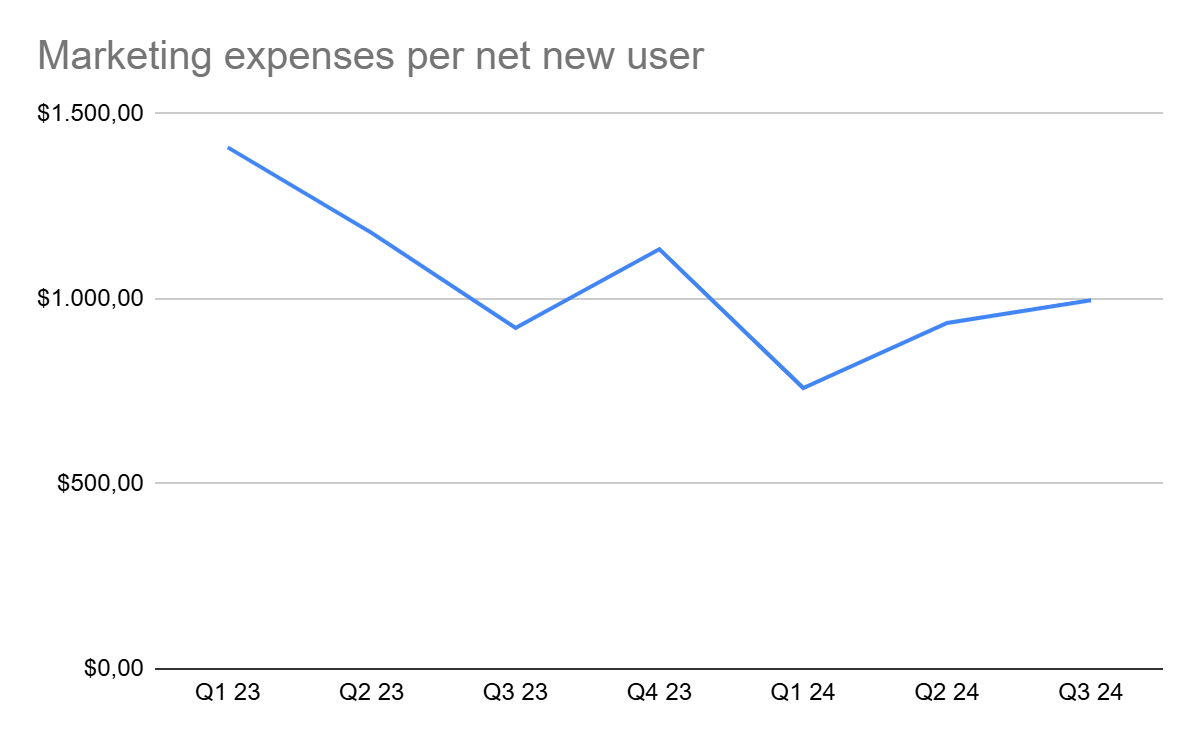

This network effect not only enhances the personalization of treatments and so the retention, but also potentially reduces the cost of customer acquisition as satisfied users become advocates, drawing in new subscribers organically. The following graph, showing decreasing marketing expenses per net new users, seems to confirm such a thesis.

As Hims continues to grow its subscriber base, the data-driven insights it gains will further refine its offerings, making healthcare more accessible, effective, and tailored to individual needs, thereby reinforcing the cycle of growth and improvement. This positions the company not just as a provider of telehealth services but as a continuously evolving health tech platform that benefits from scale in ways traditional healthcare providers cannot match.

3. How personalization increases Switching Costs

Looking at the nature of a telehealth service, retention is certainly a potential weak point for the company as users can easily switch to another telehealth service or to other medicines providers, as they find lower prices on the market.

Hims has strategically engineered its service model to increase the switching costs for its subscribers, ensuring higher retention and fostering a loyal user base.

The Q3 2024 shareholder letter reveals compelling data on this front:

According to a study done by Blue Health Intelligence earlier this year, only 70% of patients prescribed GLP-1 medications were still using those medications after the first four weeks, and by week 12 that dropped to 42%. When looking at our own data, at 4 weeks, 85% of our compounded GLP-1 users continue with their subscription. By 12 weeks, we have observed 70% of users continuing with their subscription.

This significant difference in retention rates underscores the effectiveness of Hims & Hers' approach, attributing it to "personalized dosages, breadth of treatment offerings, and frequent provider communication."

This level of service would be incredibly challenging to offer at scale to the average consumer in the typical brick-and-mortar setting.

Further elaboration comes from the Q3 earnings call where CFO Oluyemi Okupe discussed how customization leads to higher retention:

With greater customization for individual clinical needs at affordable prices, we are seeing retention drift higher across many of our specialties. For example, in some subspecialties of women's dermatology, we are seeing annual retention increased by more than 20 points year-over-year, as the mix of those utilizing a personalized solution increased 40 points year-over-year to approximately 70% of the specialty

This indicates that the more personalized the service, the less likely customers are to switch providers, thanks to the tailored fit to their specific health needs.

The financial implications of this strategy are also clear, with Okupe noting,

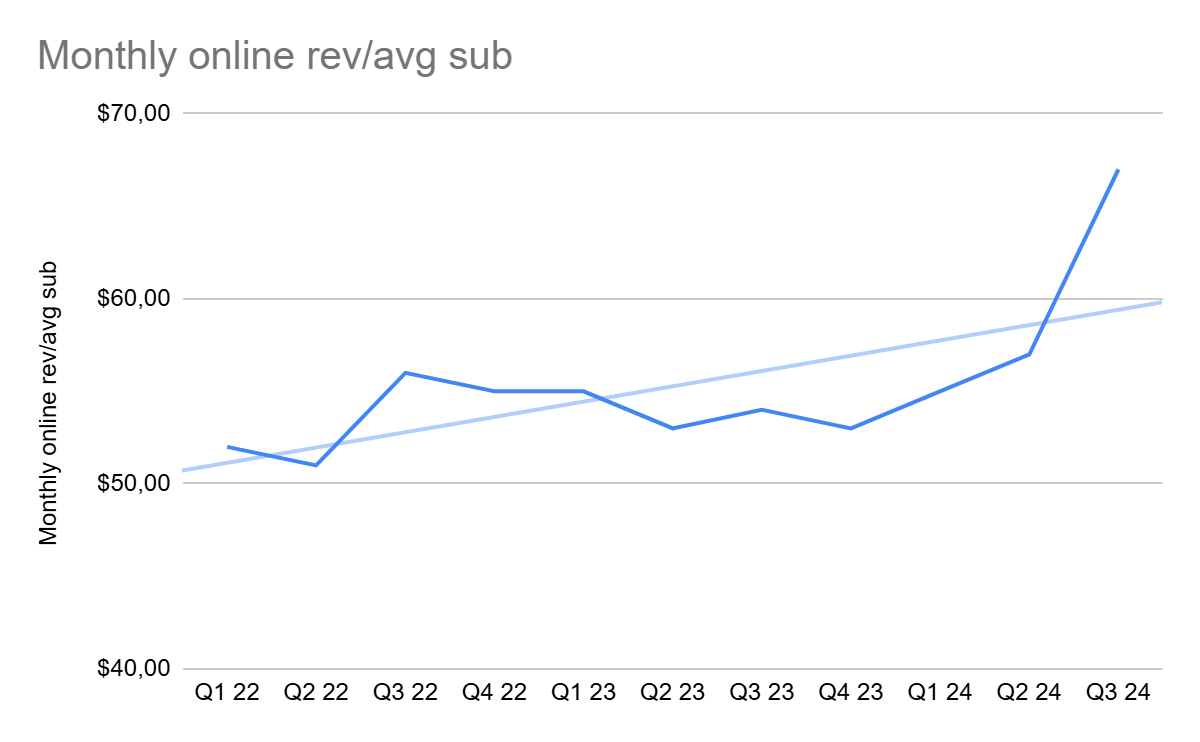

Monthly online revenue per average subscriber increased 24% in the third quarter relative to last year to $67. A continued shift to more premium personalized offerings has been one contributor towards this dynamic, which has offset headwinds from a migration toward longer duration commitments that carry a lower average monthly price.

In the following graph we can see how the positive trend of monthly revenue per average subscriber persists over time.

This shows that not only does personalization increase retention, but it also allows for higher revenue per user, further elevating the switching costs as customers are less inclined to leave for a service that might not offer the same level of customization.

The Q2 shareholder letter reinforces this narrative by highlighting the rapid adoption of new specialties. Hims noted that since its launch in 2017, most new specialties have typically reached 100,000 subscribers within 18 to 24 months. However, its more recently introduced Weight Loss specialty surpassed this milestone in just over seven months.

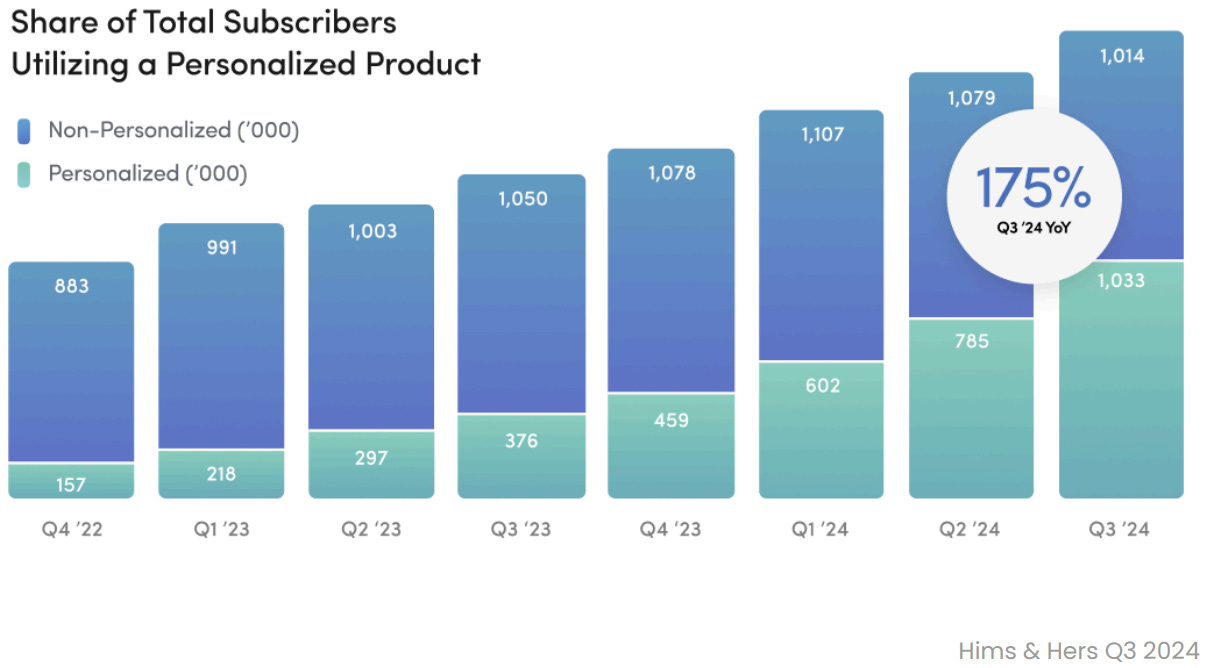

This accelerated adoption is driven in part by the high value placed on personalized solutions, which not only attract subscribers but also enhance retention by addressing multiple conditions simultaneously. In fact, the share of total subscribers using a personalized product has been increasing each quarter, rising from 15% in Q4 2022 to approximately 50% in Q3 2024.

During the Q2 earnings call, Okupe reinforced this narrative by highlighting the growing shift toward personalized solutions. He explained that as the company expands its offerings to include more multi-condition treatments, a wider variety of form factors, and customized dosages, more existing subscribers are transitioning to personalized solutions.

Additionally, new customers are overwhelmingly embracing this approach, with over 55% of new users in the second quarter opting for a personalized solution. This shift has not only improved retention but has also influenced user behavior by encouraging daily habit-forming treatments over on-demand options. As a result, switching to another platform has become less appealing, as users develop routines and build trust in Hims offerings.

Through these insights, Hims demonstrates a robust model where the costs of switching away from their platform are significantly high due to the integration of personalized, multi-condition treatments, and the community of users who benefit from and contribute to the platform's evolving capabilities.

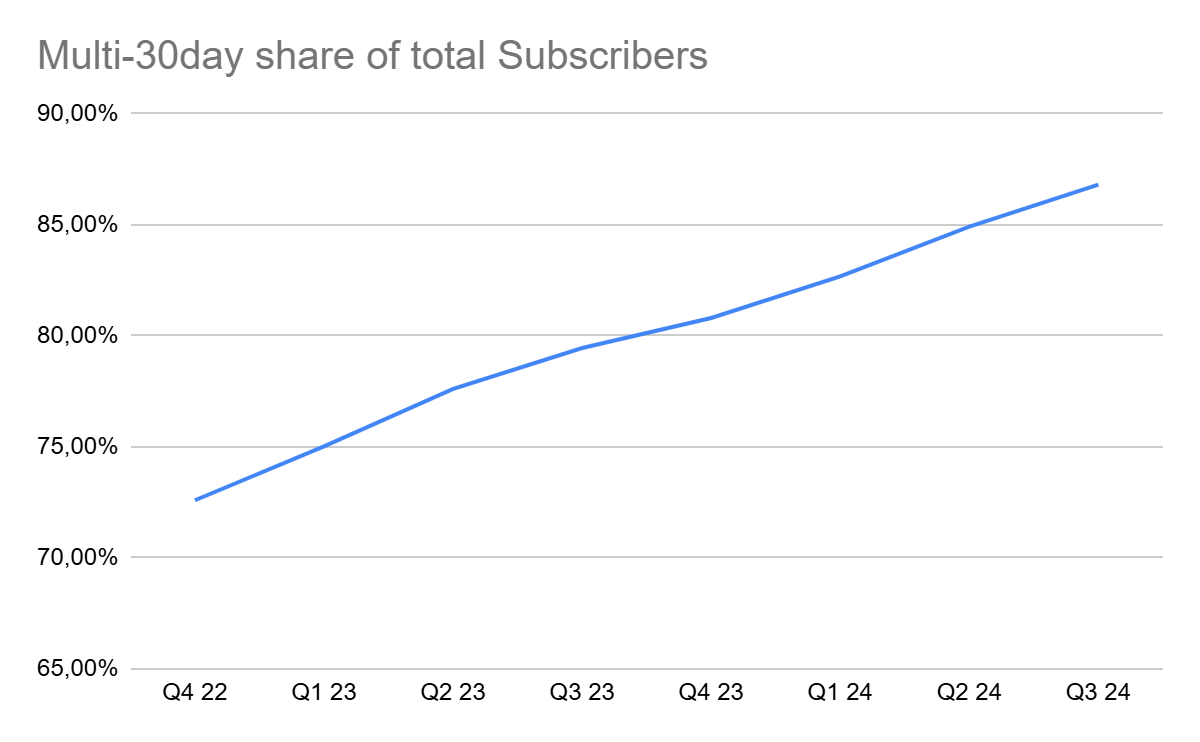

Further evidence of Hims' successful strategy can be seen in the growing share of subscribers using the platform for multiple 30-day periods, compared to those subscribing for a single 30-day period. This trend has been consistently increasing over time.

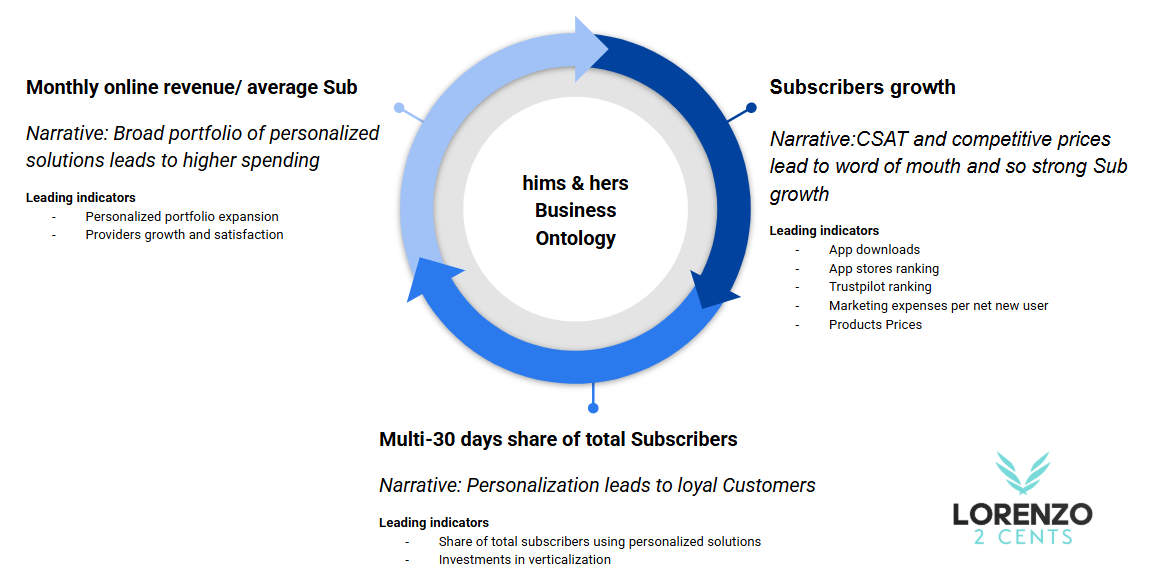

4. Hims Business Ontology

Going forward, each deep dive will feature a section called Ontology, designed to link the supported narrative to relevant KPIs. The choice of the term Ontology is a deliberate tribute to Palantir, a leader in the AI landscape and a key contributor to my 2024 portfolio performance.

This section will serve as a blueprint for my investment thesis, continuously updated to reflect the evolution of the narrative. By structuring insights this way, both my readers and I will be able to track performance more effectively and make data-driven decisions on managing the position.

Here an explanation of how to read the Ontology. For each block, you will find the following in order:

Lagging Indicator: A KPI that strongly represents the narrative but is not ideal for decision-making, as it is widely observed by the market and moves in sync with key financial metrics such as revenue.

Narrative Description: A brief explanation of the thesis behind the block.

Leading Indicators: KPIs that offer early signals of how the business is evolving. If these fail to show consistent improvement quarter after quarter, it may indicate that the thesis is incorrect or that the company’s moat is deteriorating.

The following updates will provide a dynamic representation of a digital twin built upon this Ontology, ensuring a continuous, structured analysis of the company's progress.

Follow me on X for real-time updates on how I'm managing my position.

5. Conclusion

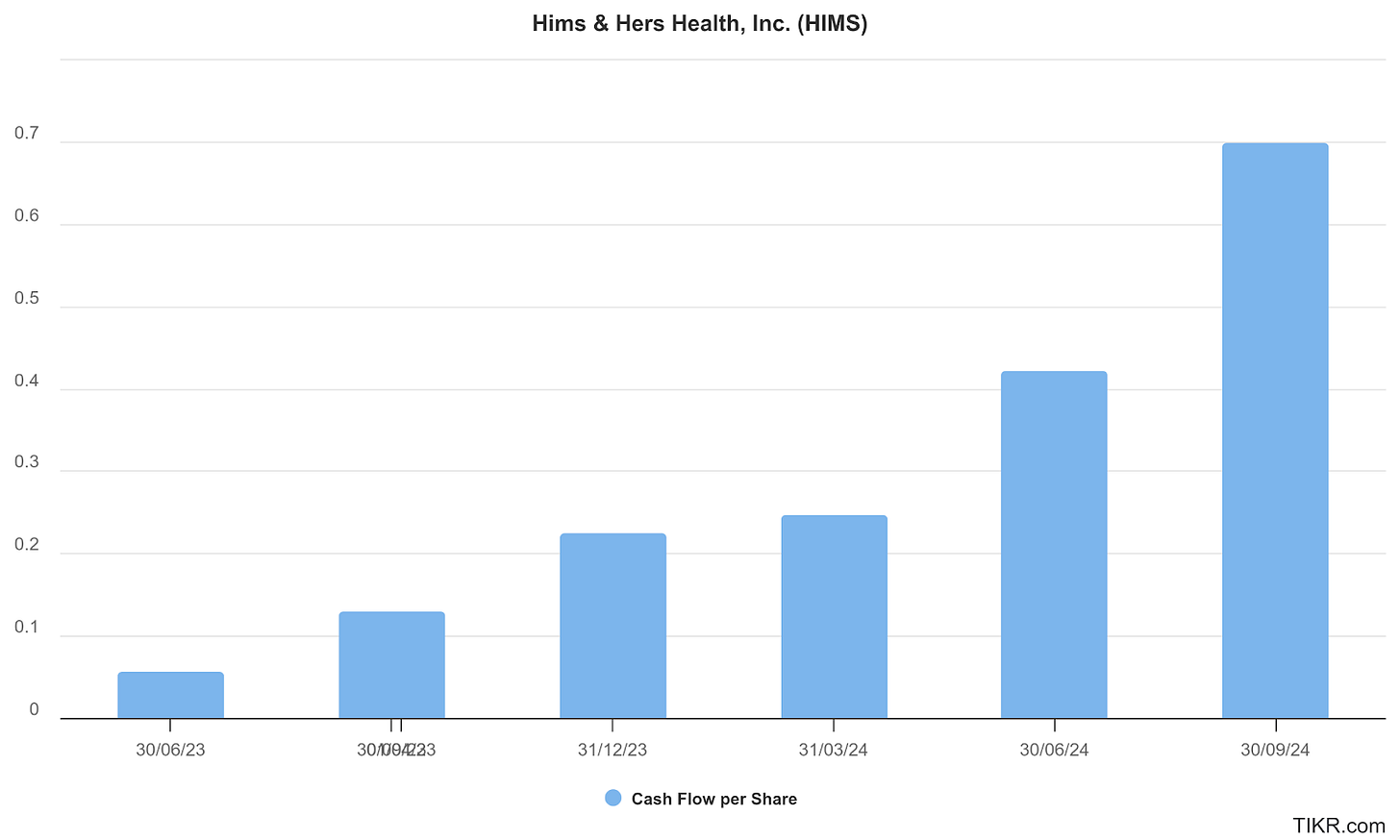

Hims' competitive moat in the healthcare industry is undeniable, and its financial performance reflects this strength. The company maintains a solid balance sheet, with a positive net financial position, growing net income, and increasing free cash flow—providing the flexibility to fund growth without relying on debt.

At the start of the year, I expressed my strong conviction in HIMS 0.00%↑ for 2025, and as of today, my portfolio allocation has exceeded 25%, with the stock already up 76% year-to-date.

Despite this momentum, Hims is still trading as if its growth is on the verge of a sharp slowdown—a perception largely shaped by media narratives suggesting that the GLP-1 drug shortage may soon be resolved. GLP-1 medications, widely used for weight management and diabetes treatment, have represented a significant market opportunity for Hims. However, during its Q3 earnings call, the company clarified that subscriber growth—excluding contributions from GLP-1—was still approximately 40% year-over-year, compared to a total subscriber increase of 44% YoY. This suggests that Hims has the potential for strong growth independent of GLP-1, countering concerns about an imminent slowdown due to potential market saturation.

Currently, Hims is trading at 7x revenue, a relatively low multiple compared to peers with similar growth trajectories. The company has guided for 89-91% revenue growth in Q4 2024.

In the long run, stock prices follow free cash flow per share, and for Hims, this metric is set for explosive growth in the coming quarters—evidenced by its recent trajectory, with its free cash flow surging 312% YoY in Q3 2024.

See you in the next update!