Lemonade: a path to growth with near-zero marginal cost?

How $LMND plans to disrupt the Insurance Industry

The founder-led Lemonade is redefining insurance with innovative AI-driven technology, delivering an unmatched customer experience and demonstrating impressive scalability. As a visionary leader in the insurtech space, Lemonade’s digital-first approach streamlines processes, lowers costs, and boosts customer satisfaction.

Their commitment to rapid growth and social impact sets them apart from traditional insurers.

Investing in Lemonade means supporting a forward-thinking company poised to dominate the market, transforming the insurance landscape and capitalizing on the demand for modern, tech-savvy solutions.

In the following sections, I seek clear evidence that Lemonade's AI flywheel is functioning effectively and that the company is on its path to revolutionize the industry and achieve remarkable growth.

Index

Overview of the company

Simplicity and quickness driving customer satisfaction and retention

A path to growth with near-zero marginal cost?

AI-powered loss-ratio optimization, the missing cherry on top?

Financials

Conclusion

Overview of the company

Lemonade is an innovative insurtech company that operates with a unique business model, leveraging technology to disrupt traditional insurance practices. Founded in 2015, Lemonade offers a range of insurance products, including renters, homeowners, pet, life, and car insurance, primarily targeting younger, tech-savvy consumers.

Lemonade's business model is centered around a digital-first approach, utilizing artificial intelligence (AI) to streamline the insurance process.

Lemonade's primary channel of advertisement is the internet, promoting ads and services through various media and social media platforms, including Facebook, TikTok, YouTube, and Instagram.

The company operates through a mobile app and website, allowing customers to easily purchase and manage their policies. Key aspects of their model include:

Reinsurance Strategy: Lemonade transfers a portion of its risk to reinsurers, which helps manage large claims and stabilize cash flow. This allows Lemonade to focus on smaller claims while offloading significant risks.

Giveback Model: A distinctive feature of Lemonade’s approach is its commitment to social impact. Excess premiums at the end of the year are donated to charities chosen by customers, fostering trust and aligning with the values of socially conscious consumers.

Customer-Centric Focus: The company aims to provide a hassle-free experience, with a claims process that can be completed in seconds for many claims, thanks to AI-driven automation.

Simplicity and quickness driving customer satisfaction and retention

Soooo simple and hassle free!!! Any insurance reimbursements are usually a headache, but with Lemonade the funds were in my account within 5 min…

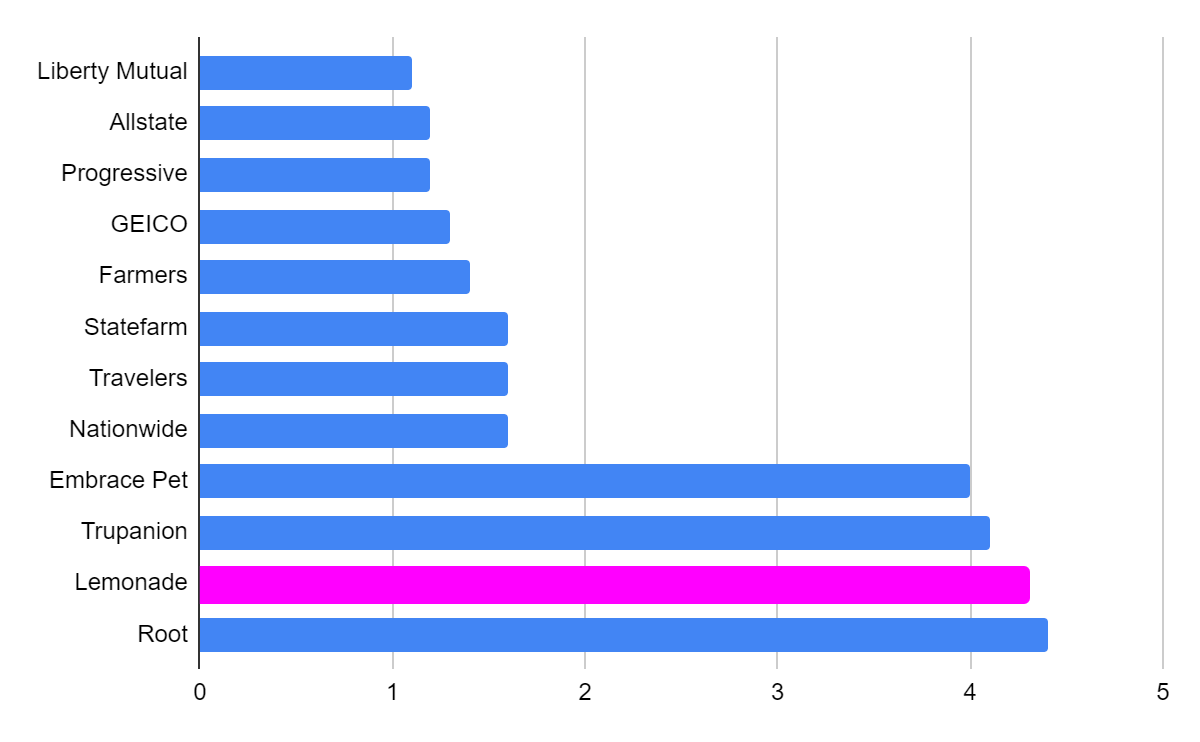

This is a common sentiment found in Lemonade reviews on Trustpilot. For comparison, let’s look at how some of Lemonade’s competitors score on Trustpilot.

In today’s competitive insurance market, customer retention is crucial. According to the Independent Insurance Agents of Dallas, the insurance industry has the highest customer acquisition costs of any sector. Therefore, keeping clients satisfied and loyal is essential for maintaining high profitability. Retention rates distinguish struggling insurance companies from thriving ones.

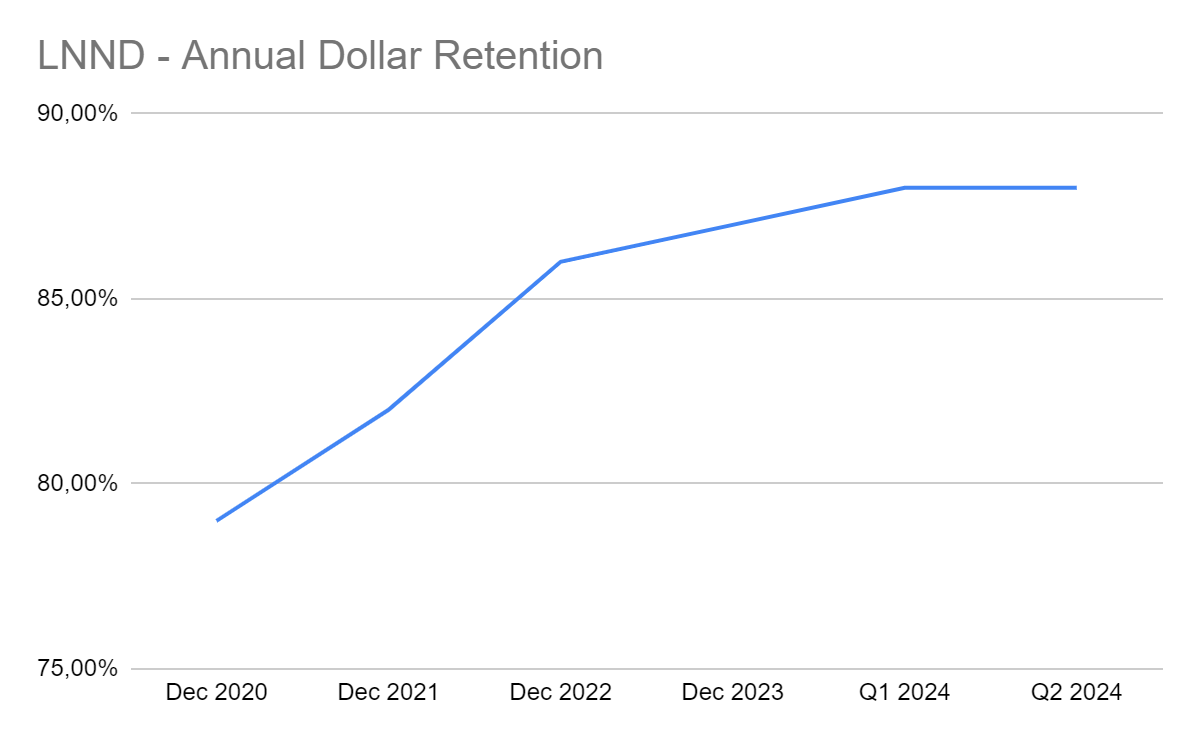

Lemonade's Annual Dollar Retention grew rapidly from 2020, reaching 88% in Q1 2024, and is expected to continue rising as the company sells more products in each state.

Key factors driving retention rates include customer claims handling and cross-selling opportunities. Trustpilot reviews provide evidence that Lemonade excels in claims handling, while its product portfolio strategy supports cross-selling.

As customers advance economically and experience various life events, their insurance needs shift towards higher value products. Renters frequently acquire more belongings and tend to upgrade to larger homes. Growing households often require car, pet, and life insurance, along with additional coverage. These transitions typically result in significant increases in insurance premiums.

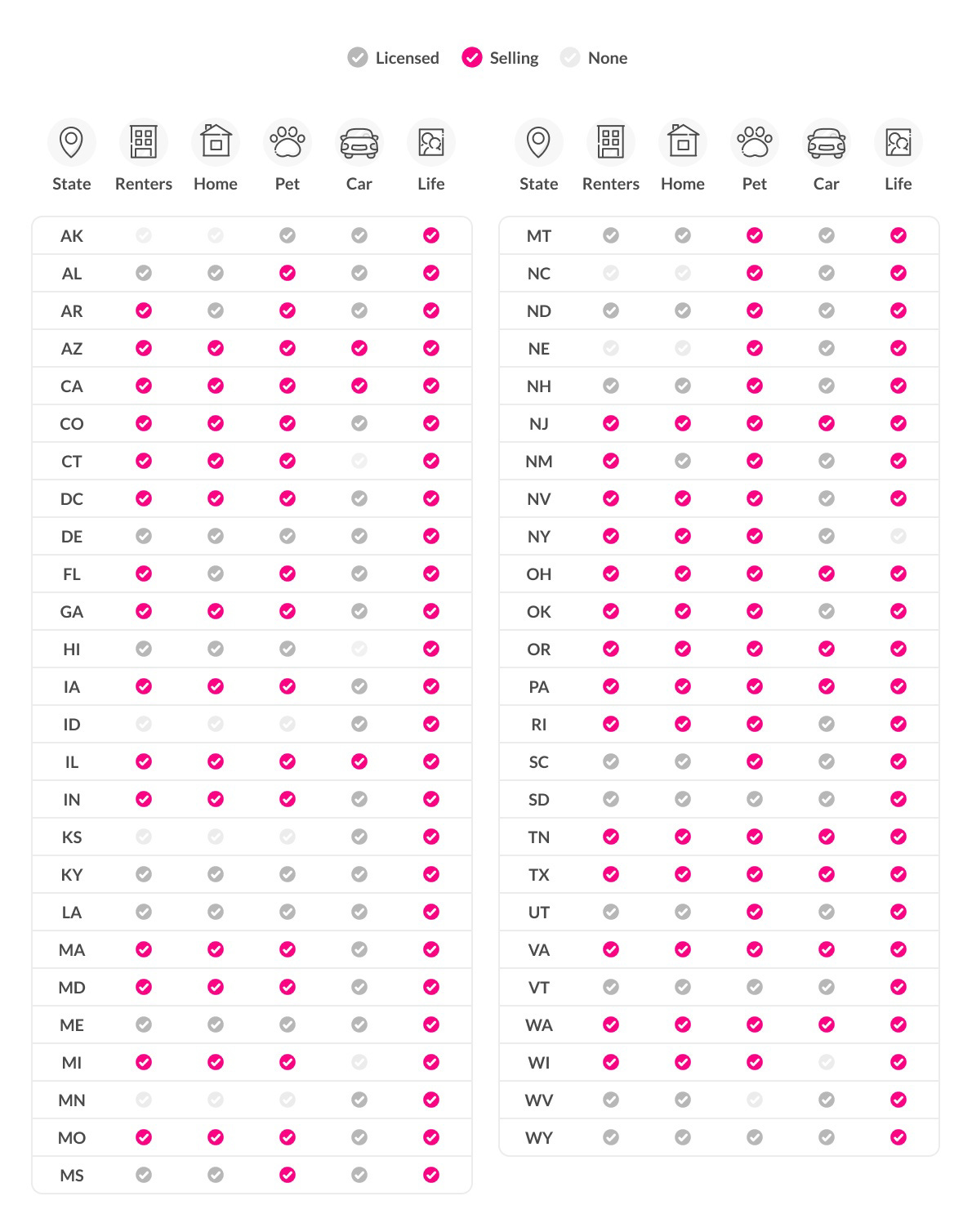

In states offering the complete range of Lemonade’s products - Renters, Home, Car, Pet, and Life - a growing number of customers hold multiple Lemonade policies.

In Illinois, for example, where we have all of our products available, we're seeing multiline customer rates that are roughly double the rest of the book. We also see other metrics improve, such as superior retention rates after bundling and outstanding customer feedback as measured by NPS

stated Shai Wininger, President and Co-Founder of Lemonade, in the last Q2 earning call.

Lemonade aims to deliver an exceptional user experience to retain customers throughout their lives, enhancing their lifetime value without additional acquisition costs.

Lemonade’s strategy of growing alongside its customers also supports the expansion into new insurance lines, as life events often necessitate additional insurance products. The company’s regulatory framework, technology infrastructure, and brand are adaptable to new insurance lines, which is expected to drive future growth. Over the past three years, Lemonade has added life, pet, and car insurance to its portfolio and plans to introduce more coverage types.

For instance, the expansion into pet insurance aligns with Lemonade’s long-term strategy of growing with its young customer base by offering new insurance experiences as they progress through life. Approximately 72% of pet insurance policies were sold to new customers, with about 6% of these customers subsequently adding a renters or homeowners policy by December 31, 2023. Customers who bundle insurance products typically save money. The remaining 28% of pet insurance policies were sold to existing customers, whose median premium per customer increased by approximately 3.7 times with minimal additional acquisition costs.

In the United States alone, as of December 31, 2023, Lemonade is licensed to sell insurance products in multiple states.

According to the Independent Insurance Agents of Dallas,

In any industry, the top five companies have a 93%-95% customer retention rate, in contrast to the average customer retention rate within the insurance industry of 84%.

Lemonade has already achieved an 88% annual dollar retention rate, placing it among the highest in the insurance industry. With plans to introduce new products and expand existing ones across more states, Lemonade is poised to achieve even higher retention rates in the future.

While many other insurance companies adopt a land-and-expand strategy as well, securing customer loyalty by selling multiple policies, Lemonade’s competitive advantage lies in its seamless, data-driven technology stack and AI-driven processes. This approach delivers a superior customer experience at a lower cost.

As of December 31, 2023, 98% of the time, it is AI Jim that will take the first notice of loss from a Lemonade customer making a claim, paying the claimant or declining the claim without human intervention. AI Jim triages and assigns claims he is not authorized to settle, or ones where he identifies concerns, to human claims experts, analyzing each expert's specialty, qualifications, workload, and schedule to determine to whom to assign the claim. Even where human escalation is needed, AI Jim will have done much of the heavy lifting so the Lemonade team can settle claims and support customers in their hour of need as quickly and smoothly as possible.

The claims process represents the most acute pain point in the insurance experience, and it is where animosity toward the industry is most commonly cultivated.

At the same time, CX.AI bot platform resolves customer requests instantly without human intervention, handling about a third of customer inquiries. It uses Natural Language Processing to manage tasks like updating policies, changing payment methods, and processing coverage adjustments efficiently.

The effectiveness of such an approach, which aims to reduce claims overhead and speeds up the claims process while enhancing customer satisfaction, is validated by the trend of claims overhead, known as Loss Adjustment Expense, or “LAE”.

LAE refers to the costs incurred by insurance companies during the process of investigating, managing, and settling insurance claims.

In the Q1 2024 shareholder letter, Lemonade stated

A LAE ratio of ~10% is typical of leading insurers with tens of billions in premium. Despite our relatively small size, Lemonade’s LAE ratio, at 7.6% in Q1, is notably better than that benchmark, showcasing how technology can dramatically drive efficiency even before the benefits of scale kicks in.

Indeed, we have nearly halved this ratio in just two years.

A path to growth with near-zero marginal cost?

98% of Lemonade’s policies are sold through AI Maya and APIs, highlighting a stark contrast with the industry norm where 95% of homeowners insurance policies in the U.S. are sold via agents1.

AI Maya bot guides customers through a simple, engaging onboarding process, personalizing coverage, creating quotes, and facilitating secure payments. By asking a limited number of high-impact questions, AI Maya reduces onboarding times while collecting valuable data for continuous improvement.

Lemonade APIs refer to the application programming interfaces provided by Lemonade to enable developers to integrate Lemonade's insurance services into their own applications and platforms, facilitating easy access to insurance products and services.

As an example, think about renters embedding an insurance option into their offer:

This digital approach allows Lemonade to onboard and serve consumers end-to-end digitally and to scale the go to market with no additional cost.

Lemonade's digital platform integrates marketing, onboarding, underwriting, and claims processing. This comprehensive integration enhances customer acquisition efficiency, customer experience, and risk mitigation. The platform's proprietary technology stack collects extensive data from customer interactions, continuously improving the process.

SGA (Selling, General, and Administrative expenses) as a percentage of revenue growth is a strong indicator that Lemonade's strategy is proving effective.

Please note that, in order to compare direct-to-consumer (DTC) companies like Lemonade and Root with traditional insurance companies, the SGA values for traditional companies were adjusted by adding "Policy Acquisition / Underwriting Costs." This adjustment accounts for the fact that DTC companies do not incur such costs, as they do not pay commissions to external agencies.

These adjusted values demonstrate that Lemonade is consistently reducing the cost of revenue growth, positioning itself to outperform well-established competitors. A critical factor in achieving an SGA percentage below 100%, which signifies the growth flywheel operating at maximum efficiency, is the annual dollar retention. Ideally, with retention around 100%, all sales and marketing efforts could be addressed to acquiring net new customers or cross-selling to existing ones, leading to an outstanding return on capital.

To understand the impact of retention on the cost of revenue growth, consider Trupanion, which reported a retention rate of 98.60% in 2023 and an adjusted SGA as a percentage of revenue growth of 66%. This explains how high retention rates can significantly lower the cost of revenue growth.

Imagine a scenario where Lemonade achieves 100% annual dollar retention and acquires new customers solely through AI Maya and APIs, with minimal advertising expenditure and no human intervention. Does this mean we would see a system capable of growing revenue with near-zero marginal cost?

In such a case, revenue growth would become primarily dependent on risk management: accepting a higher loss ratio to lower prices and capture a larger market share from competitors, or maintaining a lower loss ratio to prioritize margins. Either way, the return on capital would be outstanding.

We have already observed consistent improvement in retention, suggesting it could continue to grow, and seen how SGA as a % of revenue growth is declining. To determine if a growth with little cost scenario is feasible, let’s examine an additional data point, the web traffic of Lemonade.com, and look for signs of network effects.

The data shows that organic traffic has been steadily increasing while paid traffic has remained flat since January 2022. This divergence is encouraging and appears to support the thesis (although it isn't entirely accurate, as it doesn't account for all sources of paid traffic, such as social networks).

AI-powered loss-ratio optimization, the missing cherry on top?

Initially, when Lemonade had no proprietary data, they relied on easily obtainable industry information for pricing and underwriting, which resulted in relatively undifferentiated customer profiles. As they have grown, they use proprietary artificial intelligence algorithms to process this data, which helps determine whether to write a particular policy and at what price.

Their underwriting process is highly data-driven and leverages advanced technology. They claim their digital platform allows them to ask fewer questions while extracting significantly more data points from each customer interaction compared to their competitors. By applying machine learning to this data, Lemonade aims to identify predictive patterns that inform their underwriting decisions.

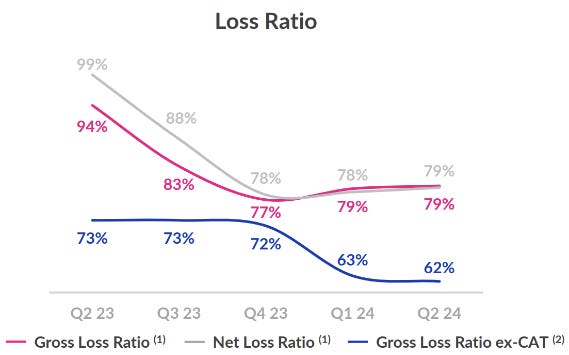

In search of data points to confirm Lemonade's claimed technology advantage, I compared their Net Loss Ratio with that of their competitors.

The results are not immediately impressive, but since December 2021, there is an encouraging trend of decreasing loss ratios. This trend becomes more evident when examining the Gross Loss Ratio excluding catastrophic losses (ex-CAT) of last 5 quarters.

I am considering the Gross Loss Ratio ex-CAT as a leading indicator of the Net Loss Ratio, given Lemonade's commitment to reducing the impact of catastrophic losses (CAT). This is evident from the last Q2 earnings call from Timothy Bixby, Chief Financial Officer:

We will be proactively non renewing customers with unhealthy lifetime value, specifically certain CAT-exposed homeowners policies. As our AIs have become increasingly good at identifying such policies, and as our latest underwriting rules have been approved by regulators, we now have the ability to identify older policies that we wouldn't write today. We expect this to remove between $20 million and $25 million of IFP from our book in the second half of 2024, dampening growth in the immediate term while concurrently boosting cash flow and profitability in the medium term and further reducing CAT volatility.

The ideal loss ratio varies by type of insurance, line of business, and specific company business models, typically ranging from 50% to 80%. For Lemonade to demonstrate its AI advantage, we would like to see it trending toward the lower end of this range.

On the other hand, it's important to note that In Force Premium (IFP) growth is directly proportional to the loss ratio: lower policy prices lead to higher loss ratios and, consequently, higher IFP growth. For a young company like Lemonade aiming to rapidly gain market share, it makes sense to prioritize growth, even at the cost of a higher loss ratio. As long as Lemonade aggressively grows its IFP, a higher loss ratio can be acceptable because it indicates they are sacrificing profitability for growth.

In this regard, Daniel Schreiber, Co-Founder, Chief Executive Officer, and Chairman of board of directors, in the last Q2 earnings call says

We are determined to have an expense load that will be absolutely better than the industry. We're beginning to look less at ratios because we also intend to be a price leader.

To measure and monitor this trade-off between loss ratio and growth, I calculated an adjusted version of the Rule of 40, commonly used to measure and compare the performances of tech companies. In this version, In Force Premium (IFP) growth is added to ‘1 minus the Net Loss Ratio’.

As Lemonade's business matures and gains more market share, the IFP growth is slowing while the loss ratio is improving.

Nevertheless, if we zoom in on the last four quarters, we observe a very encouraging trend: both IFP growth and loss ratio are improving simultaneously. This trend becomes more evident when examining the same index calculated using the Loss Ratio ex-CAT.

This suggests that Lemonade's AI engine may be starting to effectively optimize both growth and profitability.

While the proposed adjusted Rule of 40 is not entirely accurate, as it combines a backward-looking metric (Loss Ratio) with a present-looking one (IFP), it helps to visualize how Lemonade is balancing growth with profit. Although the ideal value for this index may not be exactly 40, maintaining a strong value for years to come would be encouraging.

Financials

Lemonade is demonstrating significant scalability by increasing its In Force Premium (IFP) per employee and IFP per share.

This growth highlights the company's ability to expand its premium base efficiently, leveraging its existing workforce and capital structure. Such improvements are indicative of operational efficiency and suggest that Lemonade is effectively managing its resources to drive growth.

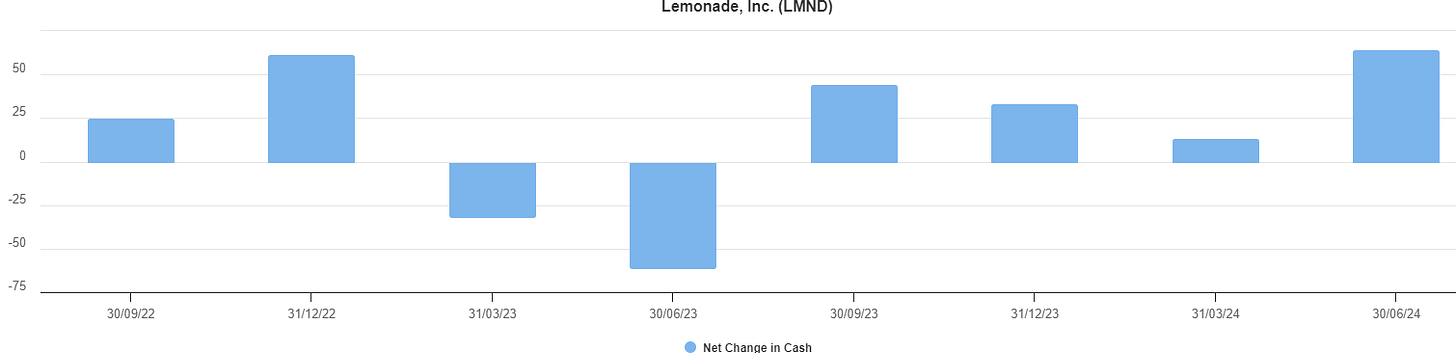

Lemonade has virtually no debt and its net cash flow is on an upward trajectory, reflecting the company's robust financial health.

As per Daniel Schreiber, Co-Founder, Chief Executive Officer, and Chairman of the Board of Directors, in the last Q2 earnings call,

We expect cash flow to be positive consistently here on out, excepting only Q4 this year where various timing issues will make that quarter a one-off exception. In any event, we don't expect our cash balances to decline by more than 1% or maybe 2% before climbing consistently.

This positive cash flow is crucial because, in the insurance business model, cash is received upfront through premiums, while costs are incurred later. Therefore, a growing net cash flow serves as a leading indicator of future earnings, underscoring Lemonade's financial stability and profitability potential.

Conclusion

Lemonade stands out as a compelling and promising investment opportunity. The company's innovative approach, driven by cutting-edge technology and a unique business model, positions it as a transformative force in the insurance industry.

Lemonade’s strong track record of rapid growth and exceptional customer satisfaction, as demonstrated by its high Annual Dollar Retention and positive Trustpilot reviews, underscores its potential.

The company's focus on leveraging AI, such as its AI-driven underwriting and claims processing, highlights its commitment to efficiency and customer-centric solutions. The promising trends in loss ratios and In Force Premium growth further validate this trajectory.

Shai Wininger, President and Co-Founder of Lemonade, closed the recent Q2 earning call emphasizing the company’s forward-looking vision:

What we've achieved so far is just the beginning. Our team has been hard at work on our next-generation technology platform, codename L2, which is designed to bring step-change improvements to areas such as underwriting, insurance operations, compliance, and product development. With L2, we anticipate additional efficiency gains alongside acceleration of our product operations. These improvements should position us to adapt quickly to market changes as well as capitalize on new opportunities, products, markets and even business models.

If Lemonade’s AI flywheel continues to improve as expected, Lemonade could indeed be on a path to remarkable growth. Given that we are still in the early stages of its evolution, the potential for Lemonade to become a multi-bagger investment is very real and the market have not fully realized it yet.

Data source is Lemonade form 10-K of December 31,2023