The content of this analysis is for entertainment and informational purposes only and should not be considered financial or investment advice. Please conduct your own thorough research and due diligence before making any investment decisions and consult with a professional if needed.

Oddity Tech delivered another robust quarter, reporting revenue of $123.6 million, reflecting a 27% year-over-year (YoY) increase. This figure significantly surpasses the company’s long-term target of 20% YoY growth, reinforcing the notion that management is likely to continue its strategy of under-promising and over-delivering in the foreseeable future.

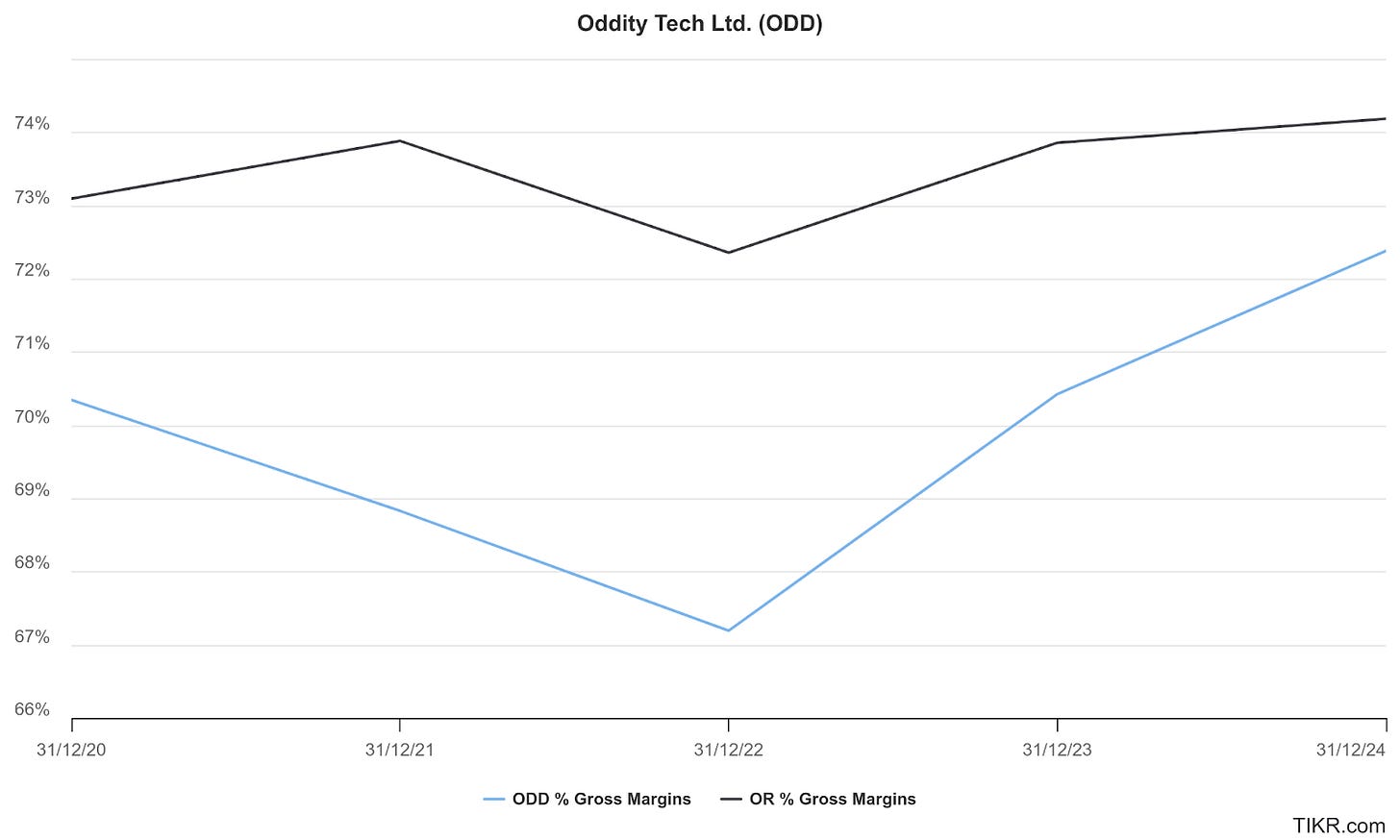

The company also achieved its highest gross margin since 2020—the earliest year for which data is available—reaching 72.7%, a 330-basis-point improvement YoY. This expansion highlights the growing value of Oddity’s brands, underpinned by the quality of its products. It also demonstrates the company’s ability to maintain premium pricing, steadily closing the margin gap with leading brands like L’Oréal, as illustrated in the accompanying graph:

If you haven't read my original deep dive on Oddity, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

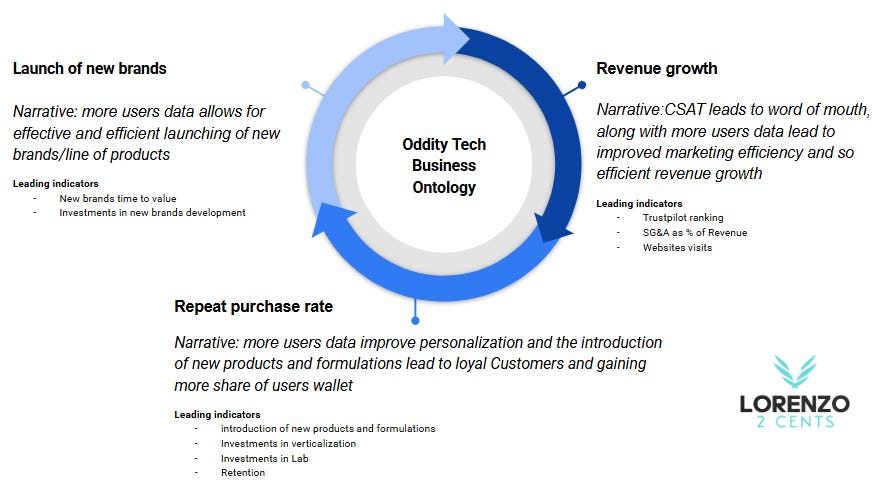

Oddity Tech Business Ontology

As with all the stocks I cover, I’ve developed a blueprint to monitor Oddity Tech’s business performance, aligned with my recently introduced Business Ontology Framework. Given that Oddity’s management provides limited metrics, having a structured and organized approach to track their progress is especially critical for this company.

Below is a visual representation of Oddity Tech’s Business Ontology, presented in a clear and structured format.

Next, I dedicate a paragraph to providing an update on each component of the Ontology.

Revenue Growth

Oddity Tech has provided revenue guidance for FY2025 in the range of $776 million to $785 million, representing a year-over-year (YoY) growth of 20% to 21%. I view this as a conservative estimate, especially considering the rising repeat purchase rates and the company’s planned launch of a new brand in 2025.

To support this perspective, let’s reverse-engineer CEO Oran Holtzman’s statements from the earnings call and derive a revenue growth estimate that may offer deeper insight beyond the provided guidance. Oran stated:

IL MAKIAGE crossed the $500 million revenue mark in 2024 and SpoiledChild recently crossed the $150 million mark for its third birth anniversary this month.” Later, he elaborated on IL MAKIAGE, saying: “it is on track to reaching $1 billion of revenue by 2028. The color business continued to grow with great repeat. Skin is a massive opportunity. As I mentioned, it reached 30% of IL MAKIAGE brand sales in 2024 and will continue to get even larger. Remember that for most of our largest competitors, skin business is twice the size of color.

Based on Oran’s comments, IL MAKIAGE—the more mature of Oddity’s two brands—is expected to roughly double its revenue in four years, from $500 million in 2024 to $1 billion by 2028. This implies a compound annual growth rate (CAGR) of approximately 19%. Given that market penetration for a maturing brand typically leads to slowing growth over time, it’s reasonable to assume this 19% CAGR may reflect a steady or decelerating trajectory across the four years. Consequently, I believe IL MAKIAGE’s growth in FY2025 could exceed 20%, aligning with or surpassing the company’s overall guidance.

Turning to SpoiledChild, Oran’s outlook further bolsters my optimism. He noted:

SpoiledChild, we are also building to be a $1 billion brand. It has scaled at a healthy rate, passing the $150 million LTM revenue mark and doing it with strong repeat rates and AOV. It shows how much unmet demand there is for the brand. We have begun testing international markets for SpoiledChild in 2025 with good indications and see a big potential there.

Given that SpoiledChild is the newer brand and is taking advantage of IL MAKIAGE customer base, I feel confident assuming it will outpace IL MAKIAGE’s growth over the same period, driven by its earlier stage of market expansion and untapped demand.

In FY2024, Oddity delivered $647 million in revenue, a 27% YoY increase, with growth distributed relatively evenly across the four quarters. This suggests the revenue growth rate may have stabilized in the short term, following a decline from the unsustainable highs of the prior three years (101% to 56%). Factoring in the upcoming introduction of Brand 3 in FY2025—though its impact will likely be modest within the year—I estimate Oddity’s revenue growth could range between 22% and 27%. This projection assumes no significant macroeconomic downturn.

A key driver of new customer acquisition will be Oddity’s expansion into international markets, as Oran emphasized:

International is another major opportunity that we have slowed play throughout the years. We began slowly accelerating our growth outside of the U.S. in the first quarter of 2025, both by increasing scale in existing markets like U.K., Germany and Australia as well as large-scale testing in new markets. So far, it looks good, and we continue to believe international will grow to big numbers.

To reinforce my thesis that customer satisfaction drives word-of-mouth growth, which—combined with enhanced user data—improves marketing efficiency and fuels efficient revenue growth, let’s examine some leading indicators. For IL MAKIAGE, the Trustpilot score stands at 4.2 out of 5 based on 79,539 reviews, down slightly from 4.3 as of July 16, 2024 (my previous record). For SpoiledChild, the score is 4.0 with 1,487 reviews (no prior period comparison available). Although IL MAKIAGE’s score dropped by 0.1 points, a rating above 4 remains impressive, especially given Trustpilot’s tendency to skew toward negative feedback.

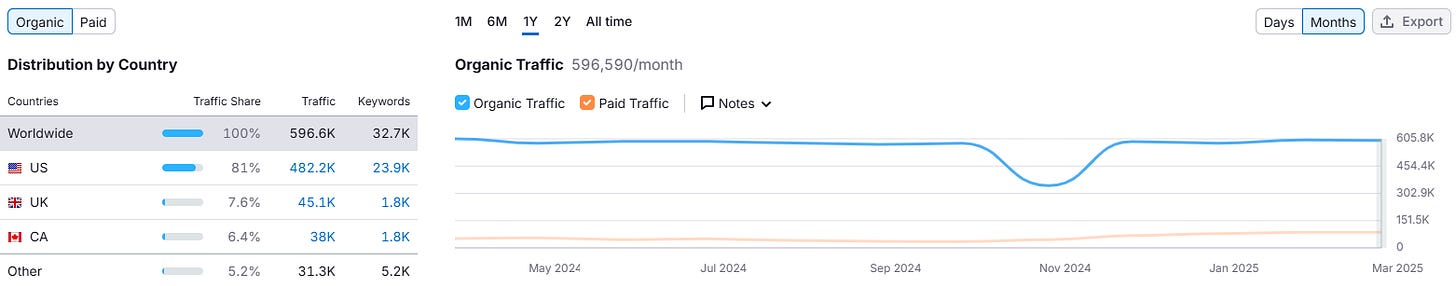

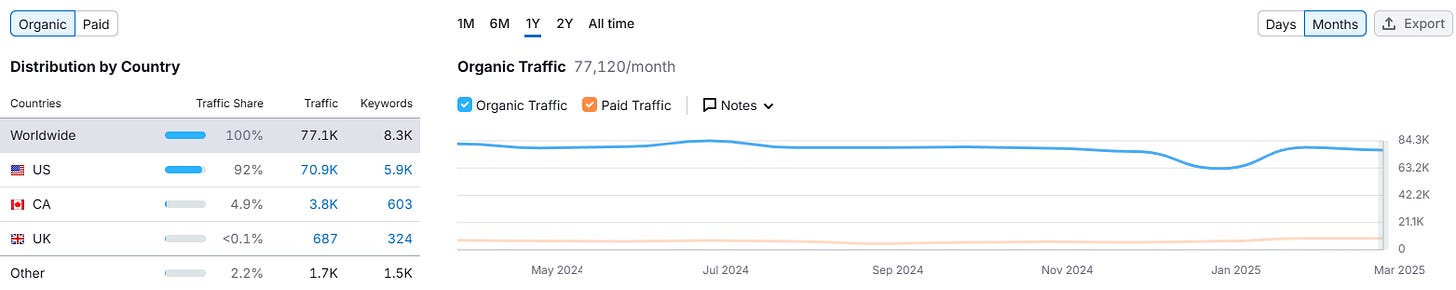

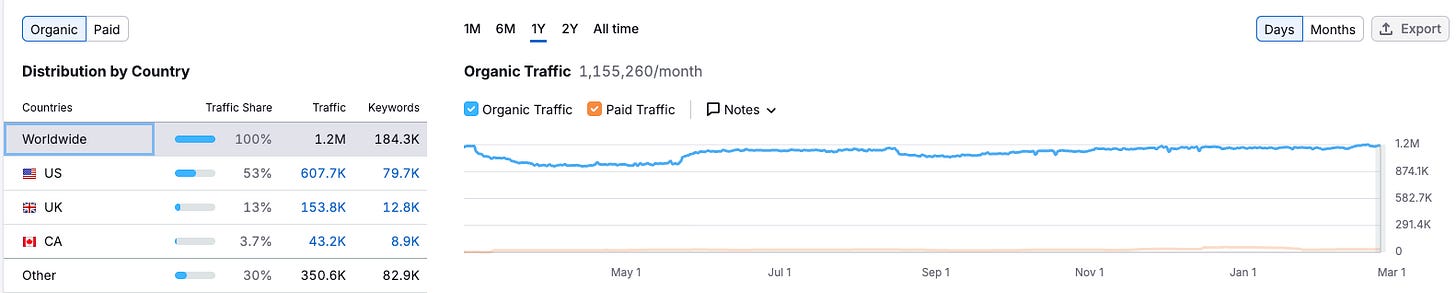

However, organic traffic to the two brands’ websites paints a less favorable picture, with both registering flat to negative year-over-year trends. This divergence warrants further exploration in the context of the company’s overall growth narrative.

www.ilmakiage.com

www.spoiledchild.com

My explanation for the remarkable revenue growth in a year, despite flat or declining organic traffic, centers on a significant increase in Average Order Value (AOV) and repeat purchases. This aligns with management’s comments during the earnings call, which highlighted “strong repeat purchase and growing AOV.”

Essentially, the two brands—IL MAKIAGE and SpoiledChild—did not attract a substantial influx of new customers, barely offsetting churn, but instead successfully engaged existing customers, who spent considerably more.

This trend raises a potential red flag, suggesting that word-of-mouth growth may not be performing as expected, which could limit the brands’ ability to expand their customer base organically.

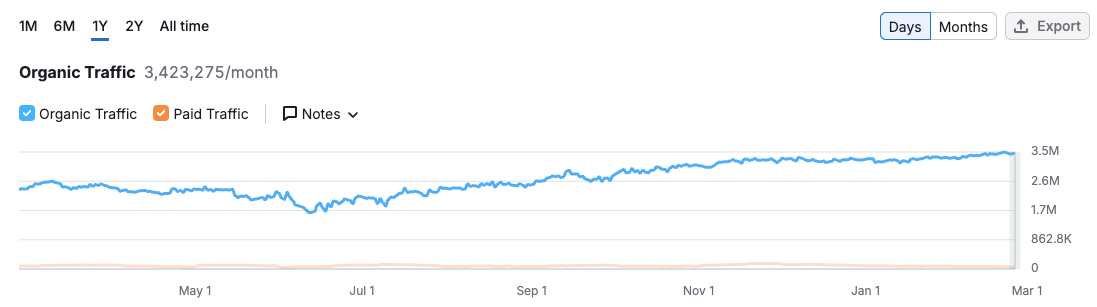

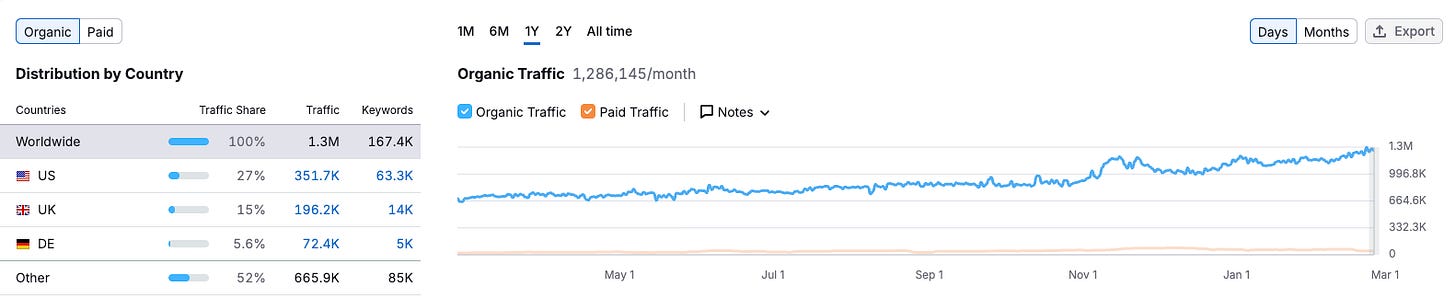

However, absolute comparisons can often be misleading and lead to flawed conclusions. To provide context, let’s compare this data with selected competitors of Oddity, chosen because they primarily sell online and thus offer a reasonably comparable benchmark:

glossier.com

theordinary.com

hudabeauty.com

The statistical sample reveals that the negative trend is not shared across all industry participants, underscoring—unfortunately—that Oddity’s flat-to-declining organic web traffic growth is a concerning development that requires close monitoring.

The final aspect I’d like to examine is SG&A as a percentage of revenue, specifically how this metric is trending.

Over the long term (three years), I’d like to see this metric trending downward, signaling that the company is becoming more efficient and successfully scaling. However, as I noted in my previous deep dive and updates, I anticipated that in the short term, it might actually trend upward. This is due to Oddity investing heavily in building the organization and infrastructure required to launch Brands 3 and 4. Indeed, from 2023 to 2024, the number of employees grew by 43%, compared to a 26% increase from 2022 to 2023. This acceleration highlights the ramp-up of operations for Brands 3 and 4, which are not yet generating revenue.

This aligns with CFO Lindsay Mann’s commentary on the 2025 outlook:

we plan to incur incremental expenses associated with growth investments in Brands 3, 4 and ODDITY LABS. This is principally to cover costs associated with people, tech infrastructure and product development. Even with these investments, we're firmly committed to delivering a 20% adjusted EBITDA margin for the full year and beyond.

Repeat purchase rate

One of Oddity’s most critical focus metrics is repeat sales. Repeat purchases are the strongest indicator of customer happiness and satisfaction, as well as the company’s ability to upsell new products to existing customers. Naturally, repeat revenue delivers high margins for Oddity and plays a pivotal role in driving the company’s impressive profitability.

Oran articulated this concept effectively during the earnings call:

Unlike most D2C companies, we generate most of our revenue from repeat, and this is although we grew over 25% so far this year. So this is why the business is so profitable. Repeat in '24 grew to more than 60% of the business revenue, way higher than 2023. Again, this is although we grew over 25%, actually 27% in revenue. This is an important metric for us because it really shows how strong the satisfaction and happiness is -- and if I dive deeper, our 12-month net revenue repeat rate is more than 100%, which we believe is among the best there is in D2C. And this metric was less than 50% comparing to more than 100% just a few years ago.

He then delved into the drivers behind this performance:

We drive repeat by three main ways. One is more repeat from the same product, foundation, concealer, hair, skin. Number two is expanding wallet share with new products. If I sold a foundation or concealer before, now we are offering her skin product, which is a repeat. And number three, we are getting cross-selling from IL MAKIAGE to SpoiledChild in the future for new brands. So this is the way that we view it. Repeat is very strong, like the cohorts that we see, we don't see any softness.

To feel confident that repeat purchases will continue to rise in the coming months, I want to see ongoing evidence of new product launches. Oran confirmed this is indeed the case:

Like any other year, around 5 products from each brand every -- have been launched.

Launch of new brands

Management has confirmed that the launches of new brands remain on track, with ongoing efforts to build the necessary organization and infrastructure.

Brand 3 is a telehealth platform designed for consumers, initially focusing on medical-grade skin and body concerns such as acne, eczema, and hyperpigmentation, with plans to expand into other health domains later. Oddity intends to soft-launch in Q3, followed by an official rollout in Q4. Oran shared:

Brand 4 is also a big opportunity that we're very excited about. More details on that front to come.

Lindsay Mann provided additional insight into Brand 3:

users will have access to both over-the-counter and prescription. The call out is really on the prescription side where there's higher cost of goods associated with doctor networks, compounding pharmacies and that kind of thing. That being said, even with a lower gross margin profile, this is a business where we expect to have great frequency and repeat. And so as for all of our brands, we demand a threshold of contribution margin, EBITDA margin, and we're really, really, really excited about the unit economic profile and financial model for Brand 3.

Oran Holtzman’s further comments gave me strong Hims & Hers vibes, suggesting that if management executes successfully, Brand 3 could potentially multiply Oddity’s market cap several times over the next few years. He added:

I would just add that we need the infrastructure for doctor just for the Rx part, which is going to be less than 50% of our offering. And everything is in place to meet our deadline for launch.

Conclusion

As usual, ODD 0.00%↑ has delivered strong results, continuing its pattern of under-promising and over-delivering.

However, with management providing scant metrics, we’re left to reverse-engineer every number, fact, and statement to construct a narrative and glean what’s happening behind the scenes. My takeaway from this earnings report aligns with what management has consistently emphasized across quarters:

Oddity is content with growth just above 20%, prioritizing instead the maximization of profitability and cash flow. This cash is being reinvested to build the infrastructure needed to launch new brands. They can sustain this approach because IL MAKIAGE and SpoiledChild are growing increasingly robust—customers are satisfied, repeat sales are rising, and the company can generate cash with minimal marketing investment.

For tech stock investors, this narrative can be hard to swallow. We’re accustomed to companies that prioritize aggressive customer base expansion for decades before shifting focus to profitability, as this is often the playbook for creating “winner-takes-all” businesses. I believe Oddity could achieve a 50%+ growth rate if it invested more heavily in customer acquisition. While this might result in lower margins, the higher volumes could ultimately yield greater cash flow.

I’ll be keeping a close eye on their website traffic trends, as I’d like to see this metric reverse soon. The current flat-to-declining trajectory is a red flag, and I won’t hesitate to exit my position if it persists over the next few months or if a second warning sign emerges.

As always, here is the “Deep Dive To Date” (DDTD), that is how the stock is performing since my initial deep dive on the July 16th 2024.

+7% DDTDSee you in the next update!