All key metrics are trending positively. At the end of the week of the earnings release on November 7, the stock closed up 20%. Is the market finally waking up? Perhaps, and likely the stock has more room to run, especially considering that as of October 15, ODD 0.00%↑ still had a short interest of 32.29% on its float.

If you haven't read my original deep dive on Oddity, I recommend doing so before reviewing this update. It's essential reading for a thorough understanding of the company.

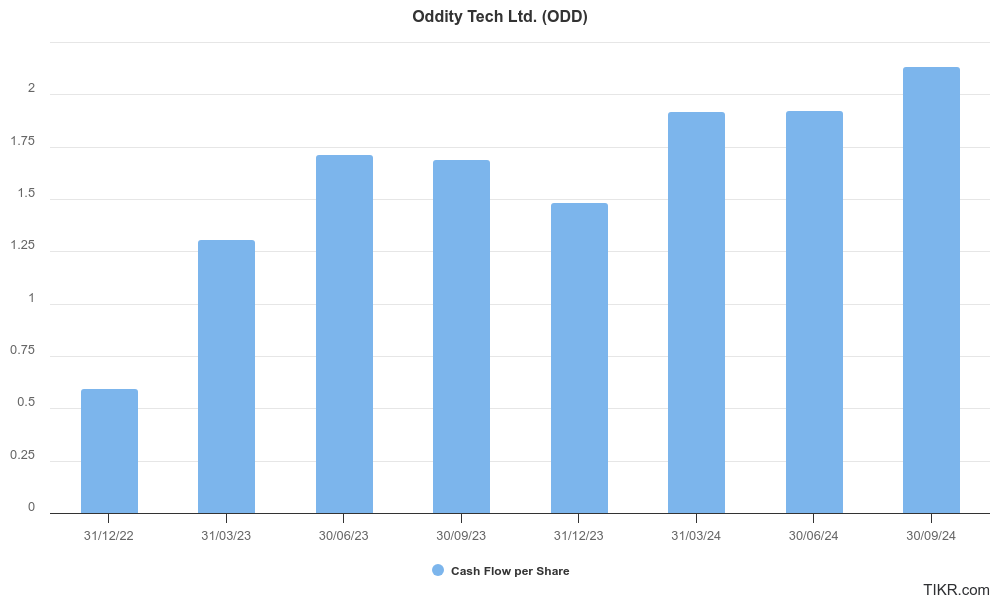

Oddity Tech exceeded its financial guidance for the third quarter (ending September 30, 2024) across all key metrics and raised its full-year 2024 outlook. The company reported record net revenue of $119 million, marking a 26% year-over-year increase, well above its 20% growth target. Free cash flow per share continues to rise, indicating that the share price is likely to follow suit.

Consumer loyalty to Oddity’s brands, Il Makiage and Spoiled Child, continues to strengthen, as shown by the increasing proportion of repeat purchases.

Repeat is over 50% of our revenue and increased as a percent of our mix again this year, even though we continued to grow the business more than 25%.

noted Oran Holtzman, the company's founder and CEO.

Oran shared insights into Oddity’s future growth drivers, including updates on Brand 3, a direct-to-consumer telehealth platform aimed at consumers with skin and body concerns, which is set to launch in the second half of next year, alongside Brand 4.

Both brands will target the existing IL MAKIAGE and SpoiledChild customer base, suggesting rapid growth potential.

Discussing Brand 3’s progress, Oran explained,

We’ve established a robust telehealth infrastructure, including a physician network and pharmacists to enhance the user experience and deliver personalized treatments. We’re also conducting large-scale consumer studies to extensively test our new products and treatments. Because they’re highly personalized and customized, they require significant work.

Oran also disclosed new details about the use of generative AI in treatment planning:

We’re developing generative AI models to show expected treatment progress over a multi-week period—an addition we’re very excited about for its potential to improve outcomes and set better user expectations.

Highlighting the strategic role of Oddity Lab in future growth, Oran added,

Our team now includes 60 scientists, with new talent in bioengineering, computational science, chemistry, and delivery. We recently expanded with a new lab in Kendall Square, Boston. I am fully committed to Oddity Lab’s success and believe it could position us as one of the largest beauty companies in the world.

In conclusion, I remark that my only ongoing concern about Oddity is that management shares few key performance indicators, which makes it challenging to see what’s happening behind the scenes. However, we have to trust Oran and the numbers; the future looks promising. Oddity remains priced for a worst-case scenario, offering an asymmetric investment with significant upside potential.

See you in the next update!

Hi Lorenzo, thanks for your very detailed analysis, it seems to me you are doing a fine job, I hope you keep up the good work.

I am invested in Oddity and was hesitant with regards to my commitment, but after reading your article, and the other articles you have published, I am feeling more confident. I will stay invested, let's see how it plays out!

Best regards, Jorge