RocketLab's Ascent: An IT Analogy for the Space Economy

An obvious call option for exposure to the space economy

I've been invested in RocketLab for a while now. Even though I saw the company's potential early on, I found it hard to figure out how it fits into the broader space industry. The space economy isn't exactly straightforward, and its commercial development is still pretty new. You can't just wing it—you have to dive deep.

This summer, I finally took the time to do just that. While lounging on the beach, I spent some hours digging into the company and the industry. I'm no expert, but I came up with an analogy that might help others understand RocketLab's position better.

In the growing space economy, RocketLab ($RKLB) isn't just another player; it's a key one, much like AMD in the IT world, while SpaceX is more like NVIDIA. Here's how that comparison breaks down.

The Hardware: Rockets as AI Chips

NVIDIA's GPUs are essential for AI and high-performance computing. Similarly, SpaceX's reusable rockets are the backbone of modern space exploration, providing the "computational power" to access space.

RocketLab, like AMD, offers a strong alternative. Just as AMD chips compete with unique architecture, RocketLab's Electron rocket provides specialized launch windows and tailored services for small satellites, making space more accessible and affordable. It is a breakthrough in small satellite launches, using innovative 3D-printed engines and carbon composite structures.

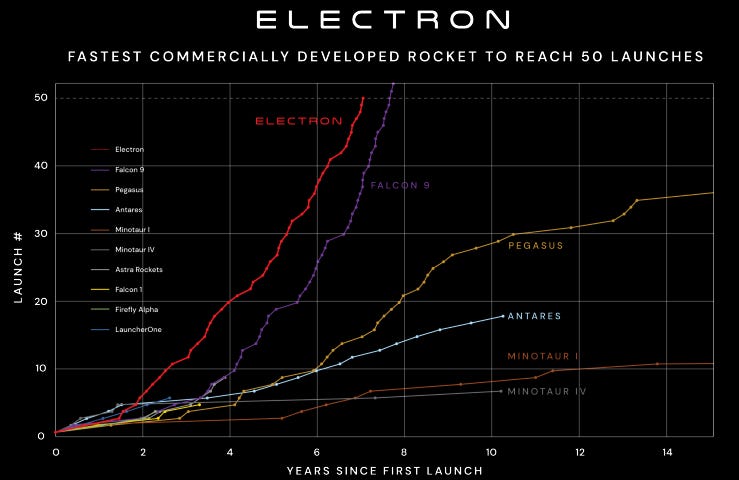

In their Q2 earnings presentation, they state that Electron accounts for 64% of all non-SpaceX orbital U.S. launches in 2024 so far, making it the undisputed leader in small launches.

Across nine launches year-to-date we’ve demonstrated differentiated capabilities that show why many satellite operators are prepared to pay a premium for Electron

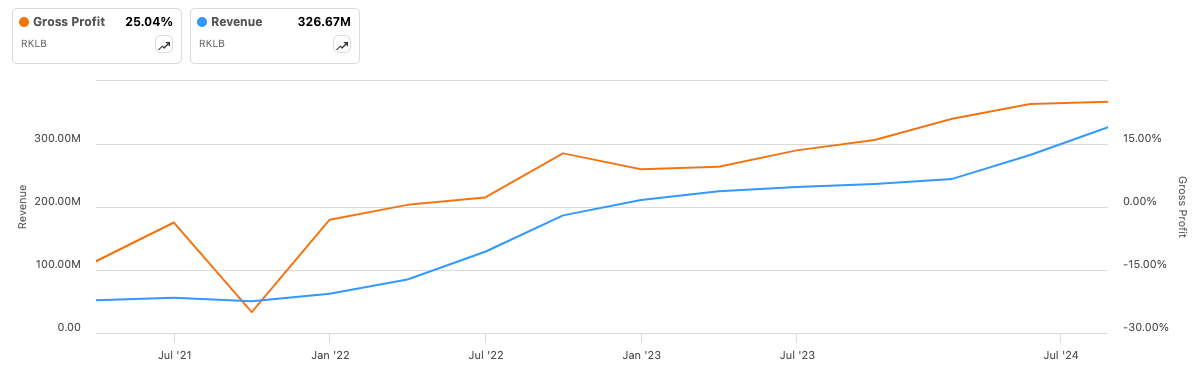

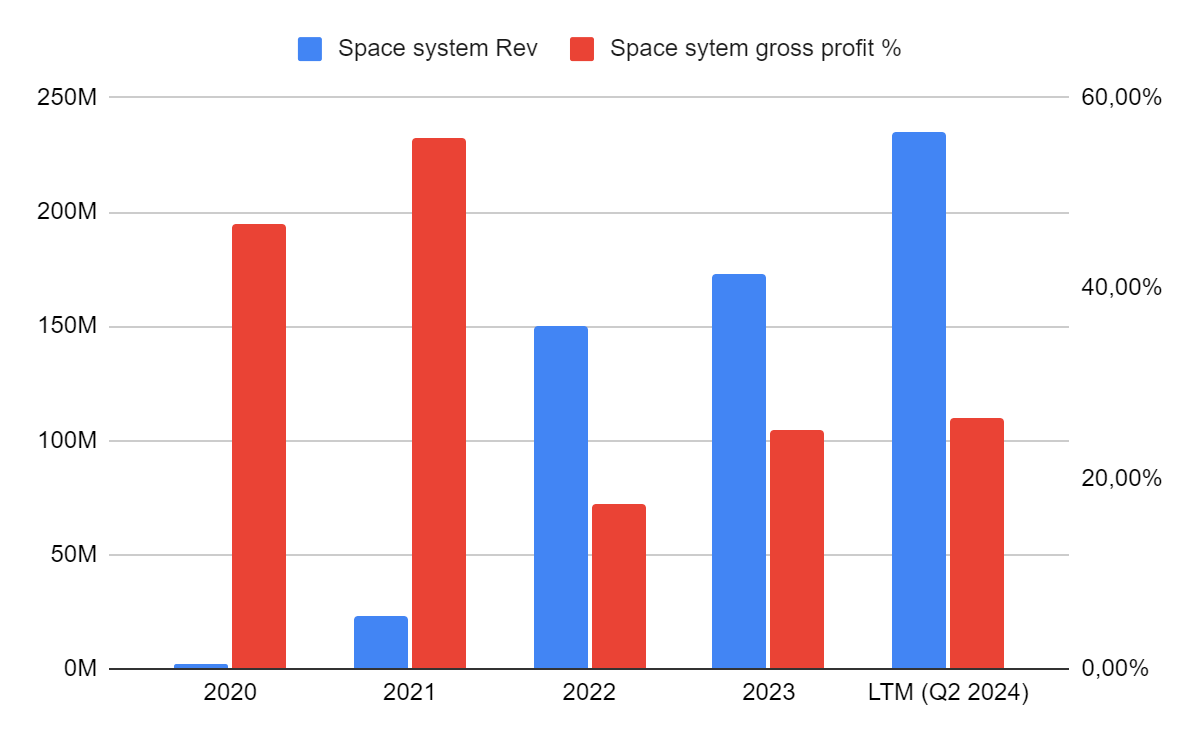

We can observe signs of RocketLab strengthening its competitive edge by analyzing the historical trends in its gross profit margin and revenue. The improvements in both metrics suggest that the company is not confined to a cost-plus pricing model, which is often used in government-led space projects. Instead, they are increasing their margins while sustaining robust growth.

One example of differentiator leveraged by the company is the Pinpoint deployment accuracy: while the Industry margin for deployment is typically ~15 kilometers, Electron delivered within 8 meters. This demonstrates why Electron is sought-after for the most complex and unique small launch missions:

rendezvous and proximity operations, efficient constellation deployment, significantly reducing phasing time

constellation replenishment

multiple deployments on same launch to different planes and altitudes

customized orbits.

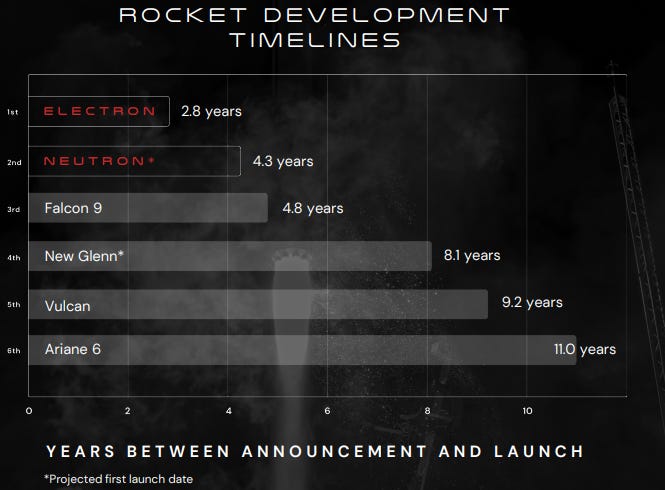

Looking at the near future, their upcoming Neutron rocket aims to cater to larger payloads in the heavy-lift market, directly threatening SpaceX’s Falcon 9 monopoly, akin to AMD pushing into data centers with its EPYC processors. And RocketLab is also working on reusable rocket technology, which will eventually bring down launch costs, following SpaceX's lead.

There's no reason to doubt RocketLab's ability to execute, as this graphic shows.

And looking at the expected development timeline, Neutron rocket appears to be on a promising path, following in the footsteps of the Electron rocket towards success.

With the Electron rocket, RocketLab generated around $30M in revenue per quarter in Q1 and Q2 and ended Q2 with a $294M backlog, from $248,3M disclosed in Q4 2023. The annualized ~40% growth of the backlog makes me believe a strong revenue growth is sustainable for the coming quarters.

One advantage RocketLab has is owning its own launch facilities, unlike many competitors who use third-party sites. This allows for quicker turnaround between launches and a high launch frequency, which is critical in the growing satellite market where timing matters.

They operate a private launch complex in Mahia, New Zealand (LC-1), which benefits from a unique U.S.-New Zealand treaty allowing the use of U.S. technology that other non-U.S. launch sites cannot access. This private complex gives Rocket Lab control over its launch schedule and availability. LC-1 has two launch pads, capable of supporting up to 120 missions annually. Additionally, Rocket Lab operates a dedicated launch pad (LC-2) at NASA’s Wallops Flight Facility in Virginia, supporting defense needs and licensed for 12 missions per year.

Rocket Lab has established itself as a leader in the small satellite launch market, which is seeing increased demand due to the proliferation of smallsats for various applications like Earth observation, internet services, and more.

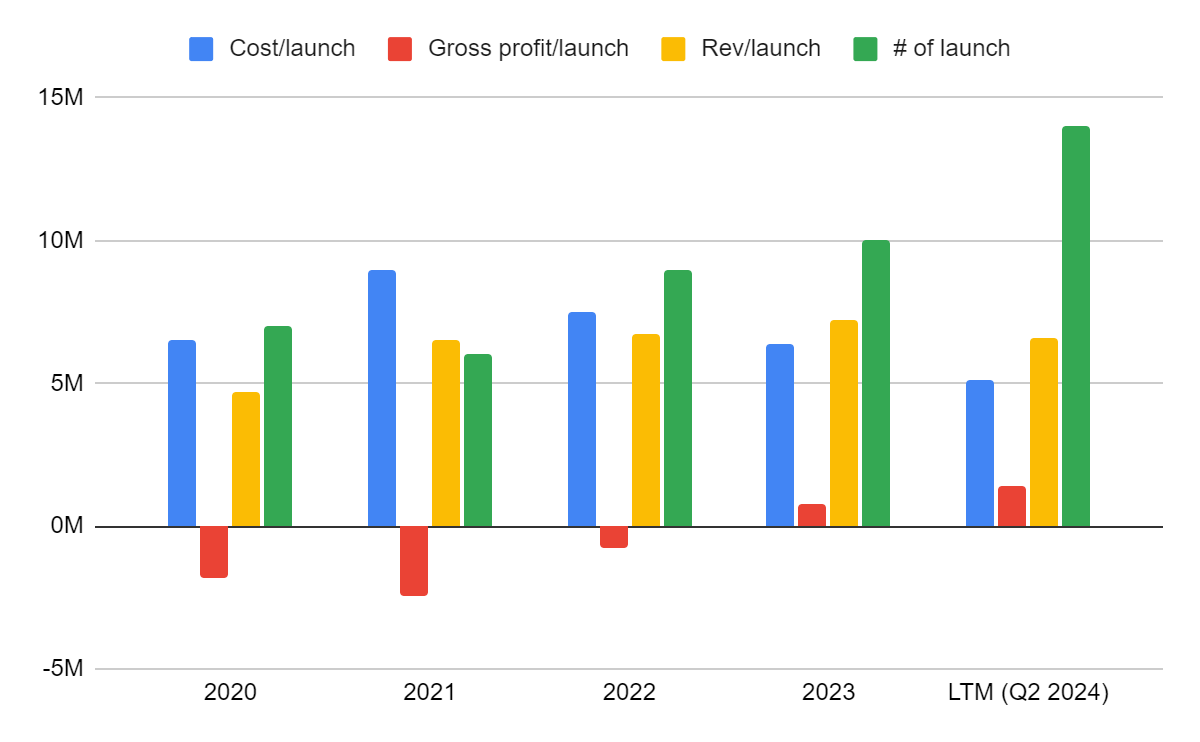

Examining the cost per launch trend, it is clear that RocketLab is steadily achieving scale. As the number of launches increases, the cost per launch decreases, leading to an improvement in gross profit.

As noted by RocketLab's CEO, Sir Peter Beck, during a recent earnings call, their target gross margin for launches is 50% (currently ~26%), and they expect to achieve this once they reach 24 launches per year. This goal is attainable by 2025 if the current growth trend continues.

And with the first Neutron expected to be launched around mid-2025, RocketLab is well-positioned to capitalize on a ~$10B launch TAM in record time.

The Platform: Spacecraft as AWS

Amazon Web Services (AWS) revolutionized the IT industry by providing scalable cloud computing resources. In space, this role is taken by spacecraft platforms.

A spacecraft platform refers to a standardized, modular architecture designed to serve as the foundation for various space ventures allowing scalability and versatility. It represents a shift towards more efficient, cost-effective space missions by leveraging economies of scale and modular design principles.

RocketLab, with its Photon spacecraft, is venturing into this domain. Photon can be configured for different mission profiles, including as a standalone spacecraft or as part of a larger mission architecture. It serves not just as a satellite bus but as a platform for various missions, including lunar and interplanetary, offering services like data relay, observation, or even in-orbit manufacturing.

Space systems now account for most of RocketLab's revenue, bringing in $76.9M in Q2. With a proven track record and a solid reputation, RocketLab is ready to grab more market share in a ~$20B TAM, backed by a $772M backlog as of Q2.

RocketLab has consistently delivered on its launches and spacecraft deployments, earning the trust of investors, customers, and partners. Winning contracts from the U.S. Space Force not only adds financial stability but also positions RocketLab as a trusted partner for government missions, which often come with higher margins.

A major competitive edge for RocketLab is its vertical integration. By controlling its launch complexes and manufacturing processes, RocketLab reduces reliance on external suppliers, potentially speeding up production, ensuring quality control and driving operating margin.

As an example, they recently completed the production of a twin satellite for NASA Mars mission where two tailored satellites were designed, built, and tested in just over three years from contract award, on time and on budget. There we can see the vertical integration strategy at work: both satellites include RocketLab solar cells, reaction wheels, star trackers, separation systems, radios, and flight software.

RocketLab's space systems division includes both complete spacecraft and components sold to other space companies, such as solar solutions, making it challenging to isolate and analyze the Photon platform's economics.

The past three years of improving profit margins, coupled with strong revenue growth, are encouraging and could be seen as an early sign that Photon is evolving into a platform, even though all projects still appear to be highly customized for each mission.

The Applications: Services from Orbit

In IT, applications running on AWS are where users interact with technology. In space, these are the services delivered from orbit: communication, Earth observation, weather forecasting, and more.

SpaceX, through Starlink, is deeply invested in this layer with satellite internet. While RocketLab has traditionally focused on launch services, it's now expanding its scope.

By developing satellite capabilities to provide direct services, RocketLab is positioning itself to offer 'applications' in space. This could include satellite-based IoT services, Earth observation data services, or even space-as-a-service, where they manage the entire lifecycle of a satellite mission—just like how software apps leverage AMD's hardware for diverse uses.

In the Q2 earnings call, RocketLab's CEO, Sir Peter Beck, laid out this vision clearly:

…the whole reason for going to space is in the first place, the data and the services that spacecraft provide.

It's the most valuable part of the supply chain, demand for it is growing worldwide, and it's what will deliver long-term recurring revenue and incremental value for shareholders.

By owning launch and spacecraft, we're at a distinct advantage when it comes to establishing our own space capabilities or constellations. We can build and launch our own spacecraft at cost, and we don't have to wait in line for limited launch capacity.

We completely avoid the pain point that most Constellation operators face being at the mercy of suppliers on cost and schedule, often causing deeply disruptive delays in bringing capability online at scale

It sure sounds like a SaaS-style recurring revenue model with a strong moat in a ~$320B TAM, doesn't it?

Conclusion: RocketLab's Strategic Position

This analogy shows how RocketLab isn't just surviving alongside giants like SpaceX, but it's thriving by offering specialized, scalable, and innovative solutions in the space economy.

As the space industry expands, RocketLab's role might not be as broad as SpaceX's, but it could be just as crucial, offering diverse, efficient, and accessible space services- much like AMD has done alongside NVIDIA.

Rocket Lab is in a strong market position, but the space industry is highly competitive and rapidly changing. To stay resilient, Rocket Lab needs to keep innovating and expanding its services while preserving its cost advantages.

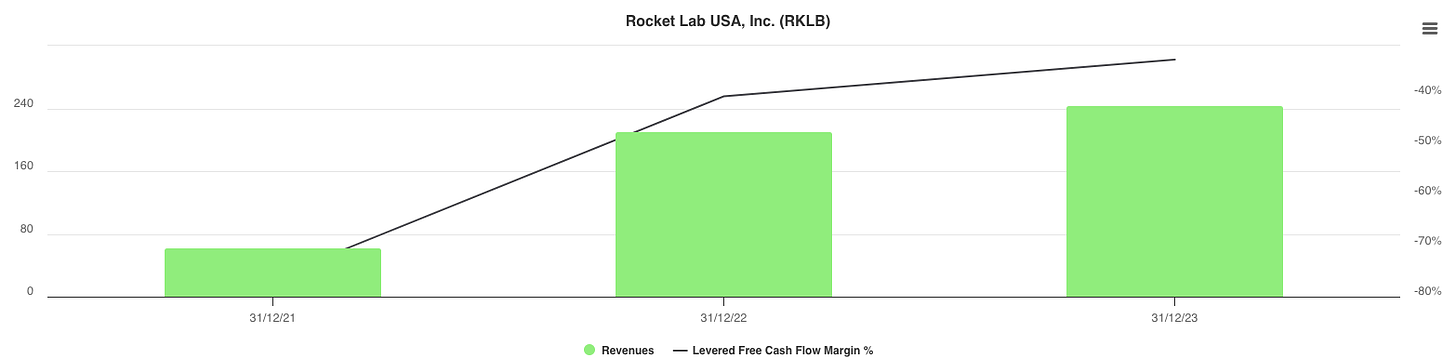

Economies of scale become increasingly significant as revenue grows, as reflected in the improving trend of the free cash flow margin.

It is expected the company will reach break-even once Neutron begins generating revenue and its development spending decreases, likely by the end of 2025.

As of Q2, they have approximately $500 million in cash and short-term investments. With a cash burn of $30 million to $50 million per quarter (free cash flow), they can sustain operations for at least 10 more quarters without additional financing, unless they furtherly execute on their vertical integration strategy pursuing other acquisitions.

Hence, if market growth projections hold true, I don't foresee any existential risks for the company.

RocketLab is a founder-led company, driven by a visionary CEO with a strong engineering background, with a proven edge in delivering end-to-end space solutions and services, which allowed it to grow revenues with a CAGR of 91% in the last three years (2021-2023) and 69% and 71% YoY growth respectively in Q1 and Q2 2024.

This investment seems like an obvious call option for exposure to the space economy.

Consequently, in my view the investment decision hinges on whether one believes that space will become a central player in the global markets, growing at double-digit rates for the foreseeable future, or if it will continue as a niche sector primarily driven by government investments.

For what concerns myself, allocating a small percentage of my portfolio to this stock feels like a no-brainer as it could easily be a 10X just executing consistently on the launch and spacecraft playbook.

But what I really want to see moving forward to increase my allocation is a proof of their ability to establish a robust recurring revenue model, potentially through offering data services from space or managed spacecraft services, which could significantly enhance their business sustainability and growth potential.

In other words, as demonstrated by the presented metrics and increasing demand from commercial and strategic customers like NASA, RocketLab has a clear competitive advantage rooted in its technology, execution capabilities, and reliability. While this advantage is essential for establishing the company as an industry leader, it isn't sufficient to create the kind of flywheel effect seen in companies that benefit from data and network effects, which can drive exponential free cash flow per share growth over an extended period.